Unclaimed Bank Accounts USA: How Banks Profit from Them

Did you know that unclaimed bank accounts USA contain over $58 billion in forgotten funds? While you’re searching for ways to stretch your budget in 2025, banks are quietly profiting from dormant accounts that rightfully belong to American families. This staggering reality affects millions of consumers who unknowingly leave money on the table.

Every year, countless Americans move, change jobs, or simply forget about old checking accounts, savings accounts, and certificates of deposit. Meanwhile, financial institutions benefit from these abandoned funds through various mechanisms that most people never discover.

Table of Contents

What Are Unclaimed Bank Accounts and Why Do They Matter?

Unclaimed bank accounts USA refers to deposit accounts that have remained inactive for a state-mandated period, typically 3-5 years. These accounts become “dormant” when account holders fail to conduct transactions or respond to bank communications.

Common Types of Unclaimed Bank Property

- Checking and savings accounts with balances under $100

- Certificates of deposit that matured without renewal

- Money market accounts left inactive after job changes

- Safety deposit box contents from closed accounts

- Cashier’s checks that were never cashed

The National Association of Unclaimed Property Administrators (NAUPA) reports that 1 in 10 Americans has unclaimed property waiting for them. In states like California and New York, the average unclaimed amount exceeds $1,000 per person.

How Banks Profit from Dormant Accounts in 2025

Banks don’t just hold your money—they actively profit from unclaimed bank accounts USA through several revenue streams that most consumers never realize exist.

Revenue Stream #1: Interest Income Generation

When your account sits dormant, banks continue using your deposits to generate income through:

- Lending activities – Your $500 checking account becomes part of a $50,000 mortgage loan

- Investment opportunities – Banks invest dormant funds in government securities and corporate bonds

- Interbank lending – Financial institutions loan dormant deposits to other banks at profitable rates

Revenue Stream #2: Fee Collection Opportunities

Many banks impose fees on inactive accounts, including:

- Monthly maintenance fees ranging from $5-25 per month

- Dormancy fees applied after 12-18 months of inactivity

- Account closure fees when transferring funds to state custody

For example, Wells Fargo and Bank of America have historically charged monthly fees on dormant accounts until the balance reaches zero or transfers to the state.

Revenue Stream #3: Extended Float Benefits

Banks enjoy “float time” – the period between when they receive your money and when they must pay it out. With unclaimed bank accounts USA, this float period extends indefinitely, allowing institutions to:

- Earn interest on your deposits while paying minimal returns

- Use your funds for profitable investments

- Benefit from inflation reducing the real value of your money over time

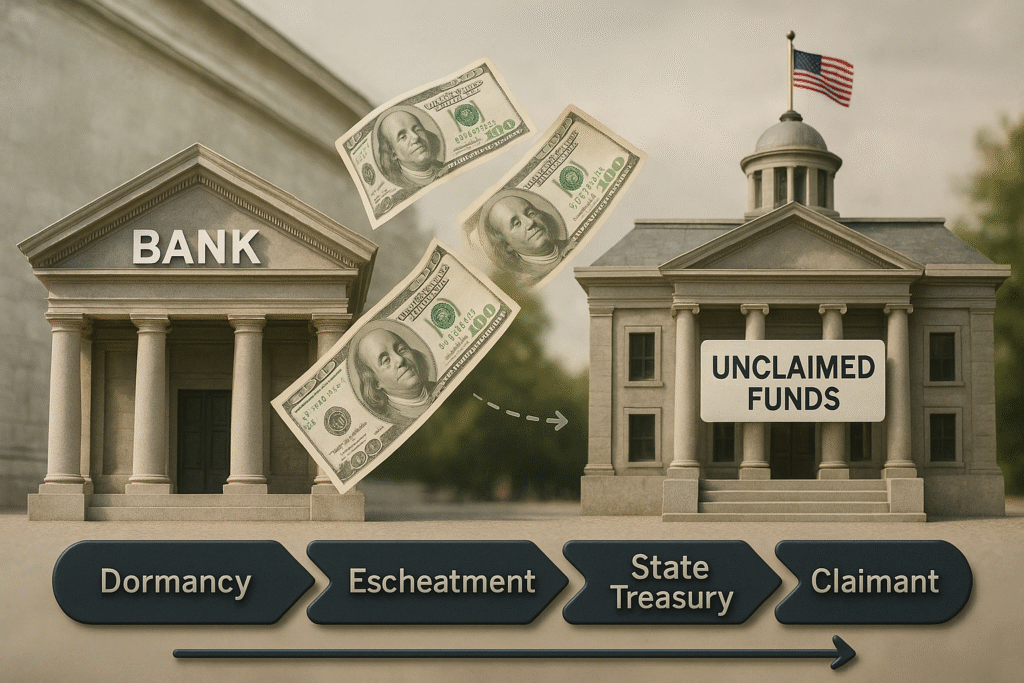

The Escheatment Process: Where Your Money Really Goes

After the dormancy period expires, banks must transfer unclaimed funds to state treasury departments through a process called “escheatment.” However, this doesn’t happen immediately, giving banks months or years of additional profit opportunities.

State-by-State Dormancy Periods

| State | Checking/Savings | CDs | Money Orders |

|---|---|---|---|

| California | 3 years | 3 years | 3 years |

| Texas | 3 years | 3 years | 3 years |

| Florida | 5 years | 5 years | 5 years |

| New York | 3 years | 3 years | 3 years |

What Happens During Escheatment

- Due diligence period – Banks attempt to contact account holders (often minimally)

- Transfer preparation – Funds move to state custody with detailed reporting

- State management – Your money earns minimal interest in state accounts

- Perpetual holding – States hold unclaimed funds indefinitely until claimed

Real-Life Examples: Americans Losing Money to Banks

Case Study 1: The Walmart Employee Account

Sarah, a former Walmart employee from Arkansas, maintained a checking account with $847 for direct deposits. After switching to a credit union in 2019, she forgot about her old Bank of America account. By 2025, the bank had collected $300 in dormancy fees before transferring the remaining $547 to Arkansas’s unclaimed property division.

Case Study 2: The Costco Credit Card Rewards

Michael from California accumulated $234 in cashback rewards on his Costco Anywhere Visa. After moving states and changing cards, he never claimed the rewards. Citibank held these funds for two years, earning interest, before transferring them to California’s unclaimed property database.

Case Study 3: The Insurance Settlement Account

After a minor car accident, Lisa received a $1,200 insurance settlement deposited into a temporary account. She moved twice and forgot about the account entirely. The regional bank charged monthly fees for 18 months before escheatment, reducing her claimable amount to $984.

How to Search for Your Unclaimed Bank Accounts

Finding your unclaimed bank accounts USA requires systematic searching across multiple databases and platforms.

Step 1: Search National Databases

Start with these official resources:

- MissingMoney.com – Multi-state search covering 42 states

- NAUPA.org – Links to individual state databases

- Treasury.gov – Federal unclaimed property information

Step 2: Check Individual State Websites

Each state maintains its own unclaimed property database:

- California: sco.ca.gov/upd_contact.html

- Texas: claimittexas.gov

- Florida: fltreasurehunt.gov

- New York: osc.state.ny.us/about/contact/unclaimed-funds

Step 3: Contact Former Banks Directly

Reach out to banks where you previously held accounts:

- Gather documentation – Old statements, account numbers, social security number

- Call customer service – Request dormant account searches

- Visit branches – Some records exist only in local systems

- Submit written requests – Banks may require formal inquiries for older accounts

Protecting Yourself from Future Account Abandonment

Prevention remains the best strategy for avoiding unclaimed bank accounts USA situations in 2025 and beyond.

Create a Financial Account Inventory

Maintain a comprehensive list including:

- Bank names and branch locations

- Account types and numbers

- Approximate balances and last activity dates

- Online login credentials (stored securely)

- Customer service contact information

Set Up Account Monitoring Systems

- Enable mobile banking with push notifications for all accounts

- Schedule quarterly reviews of all financial accounts

- Create calendar reminders for rarely-used accounts

- Link accounts to primary email addresses you check regularly

Establish Account Activity Patterns

Maintain minimal activity on all accounts:

- Make small deposits or withdrawals every 6-12 months

- Update contact information whenever you move

- Respond to bank communications promptly

- Use online banking to generate electronic activity records

The 2025 Impact: Inflation and Rising Account Values

Current inflation trends make recovering unclaimed bank accounts USA more critical than ever. The Federal Reserve’s economic data shows how recent monetary policies have created unique opportunities—and risks—for account holders.

Inflation’s Effect on Dormant Accounts

Money sitting in state custody loses purchasing power rapidly. A $500 account from 2019 now has the buying power of approximately $425 in 2025 dollars, representing a 15% real value loss. For official statistics on unclaimed property across the U.S., visit NAUPA.org.

Updated State Interest Rates

Many states have increased interest rates on unclaimed property in 2025:

- California: Now paying 2.5% annually on unclaimed funds over $100 (sco.ca.gov)

- Texas: Increased rates to 2.0% for funds held over one year

- Florida: Offers 1.75% on unclaimed property exceeding $250

Tax Implications of Reclaimed Bank Accounts

Recovering unclaimed bank accounts USA creates potential tax obligations that require careful planning in 2025.

Taxable vs. Non-Taxable Recoveries

- Principal amounts – Generally not taxable when reclaimed

- Interest earned – Taxable income in the year received

- Bank fees refunded – May be deductible if previously paid with after-tax dollars

Reporting Requirements

The IRS requires reporting of reclaimed property:

- Form 1099-MISC for amounts over $600

- State tax implications vary by jurisdiction

- Professional consultation recommended for large recoveries

For more information about tax changes affecting your finances, check our guide on OBBB tax changes 2025.

Advanced Strategies for Maximizing Recoveries

Sophisticated approaches can help you recover more money from unclaimed bank accounts USA situations.

Working with Heir Finders

Professional heir finders can locate unclaimed property for deceased relatives:

- Contingency fees typically range from 10-35%

- Research capabilities exceed individual efforts

- Legal expertise for complex estate situations

Batch Processing Multiple Claims

When claiming multiple accounts:

- Organize documentation by state and institution

- Submit simultaneous claims to reduce processing delays

- Follow up systematically with each jurisdiction

- Maintain detailed records for tax purposes

Negotiating with Banks

Some situations allow negotiation:

- Fee reversals for accounts escheated due to bank errors

- Interest adjustments when banks failed proper notification procedures

- Expedited processing for hardship situations

Common Mistakes That Cost You Money

Avoid these costly errors when dealing with unclaimed bank accounts USA:

Documentation Mistakes

- Insufficient proof of identity delays claims processing

- Missing account information prevents successful searches

- Outdated contact details cause communication failures

Timing Errors

- Delaying searches allows more fees to accumulate

- Missing deadlines for claims in some jurisdictions

- Ignoring notifications from banks or states

Process Shortcuts

- Skipping official channels leads to scam exposure

- Paying unnecessary fees to recovery services

- Incomplete applications result in claim denials

The Future of Unclaimed Bank Accounts

Technology and regulatory changes are reshaping how unclaimed bank accounts USA are managed and recovered.

Digital Banking Evolution

Modern banking reduces but doesn’t eliminate dormant accounts:

- Automated notifications keep customers engaged

- Mobile app alerts prevent account abandonment

- AI-powered monitoring identifies inactive patterns

Regulatory Developments

New regulations aim to protect consumers:

- Enhanced disclosure requirements for banks

- Standardized dormancy periods across states

- Improved search databases with real-time updates

Blockchain Integration

Some states are exploring blockchain technology for:

- Permanent record keeping of unclaimed property

- Automated distribution to verified owners

- Reduced administrative costs for states and banks

If you’re working on improving your overall financial health while searching for unclaimed funds, our guide on boosting your credit score in 6 easy steps can help strengthen your financial foundation.

FAQs About Unclaimed Bank Accounts USA

Q1. How do I find out if I have an unclaimed bank account in the USA?

Most states have free online databases like MissingMoney.com and NAUPA.org where you can search using your name and state of residence.

Q2. How long do banks keep unclaimed bank accounts before sending them to the state?

Typically, banks hold dormant accounts for 3–5 years before turning them over to the state treasury through a process called escheatment.

Q3. Do I have to pay taxes on money recovered from unclaimed bank accounts?

The original principal is usually not taxable, but any interest earned while the funds were in state custody may be considered taxable income.

4. Can I claim unclaimed bank accounts for deceased relatives?

Yes. Most states allow legitimate heirs to claim funds with proper documentation such as death certificates and proof of relationship.

Q5. Can banks charge fees on unclaimed or dormant accounts?

Yes, many banks deduct maintenance or dormancy fees before funds transfer to the state, which can significantly reduce the recoverable amount.

Take Action Today: Your Money Is Waiting

Don’t let banks continue profiting from your forgotten funds. Unclaimed bank accounts USA represent billions of dollars that rightfully belong to American families struggling with 2025’s economic challenges.

Start your search today using the resources and strategies outlined in this guide. Every month you delay potentially reduces your recoverable amount through fees and inflation.

Ready to maximize your financial recovery? Start saving smarter with SmartSaveUSA.com – your trusted source for practical money management strategies that put more cash back in your pocket.