Introduction

Inflation remains one of the hottest financial topics in America. In September 2025, all eyes are on the latest numbers and for good reason. The US inflation September 2025 report could bring surprises that affect your wallet, from rent and groceries 🛒 to interest rates and investments 📈.

In this article, we’ll break down what’s happening, what to expect, and how you can prepare.

Table of Contents

📊 What Is Inflation and Why It Matters

Inflation simply means rising prices over time. The Consumer Price Index (CPI) and Producer Price Index (PPI) are the two main measures, and they directly affect:

- How much you pay for essentials (food, housing, energy)

- Federal Reserve decisions on interest rates 🏦

- Your paycheck’s buying power

- Your household budget

👉 According to the Bureau of Labor Statistics inflation data for September will be a key signal for whether prices are stabilizing — or climbing again.

🔎 US Inflation September 2025 Forecast

Economists are predicting mixed results: some categories could ease, while others may climb. The US inflation forecast 2025 highlights:

- Energy prices may remain volatile due to global supply constraints.

- Housing costs continue to pressure families.

- Food prices, though stabilizing, remain higher than pre-pandemic levels.

The September 2025 inflation trends will show whether the Federal Reserve can finally pivot toward rate cuts, or if more patience is needed.

🏠 Housing Costs: The Biggest Pain Point

One of the hardest-hitting areas for households is rent and mortgages. Rising housing costs in the backdrop of US inflation September 2025 mean families are spending more of their income just to keep a roof overhead.

For a deeper dive into housing affordability, you can check official resources like the Federal Reserve Economic Data (FRED) for detailed inflation and housing cost trends.

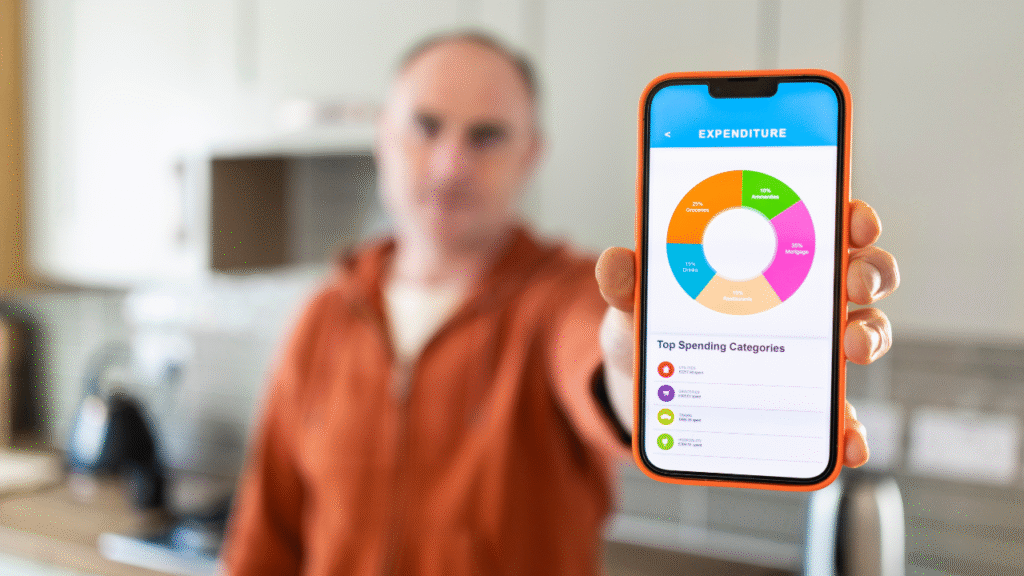

💳 How Inflation Affects Households

The reality is simple: when prices rise, families feel the pinch. How inflation affects households in September 2025 includes:

- Groceries & Dining 🍎 – Food remains one of the most visible price increases.

- Transportation 🚗 – Higher gas prices mean higher commuting costs.

- Utilities ⚡ – Rising energy bills add pressure.

- Debt Payments 💳 – Credit cards and loans remain expensive while rates stay high.

👉 Want tips to offset costs? Check out our guide on saving on streaming services to trim monthly bills.

🏦 Federal Reserve Inflation Outlook

The Fed plays a central role in shaping inflation outcomes. In September, the Federal Reserve inflation outlook will be closely tied to whether policymakers cut rates or hold steady.

- If inflation cools ✅ → rate cuts may arrive, lowering borrowing costs.

- If inflation stays stubborn ❌ → high interest rates will continue to pressure borrowers.

This impacts mortgages, car loans, student loans, and even your savings account interest.

📉 Stock Market & Investments After US Inflation September 2025

The America inflation September 2025 report doesn’t just affect households — it also shakes up Wall Street. Investors react strongly to inflation data because it drives Federal Reserve decisions.

- Stocks 📈 – Tech and growth stocks may fall if rates stay high.

- Bonds 💵 – Safer assets like Treasury bonds gain attention during high inflation.

- Retirement Accounts – Your 401(k) and IRA returns may fluctuate depending on Fed policy.

👉 Smart Move: Consider diversifying investments with inflation-protected assets such as TIPS (Treasury Inflation-Protected Securities).

🛒 Rising Costs in America 2025

Beyond the numbers, here’s where families are paying the most:

- Rent & Housing – Up over 5% YoY

- Healthcare Costs 🏥 – Insurance and medical bills climbing

- Groceries – Essentials like milk, eggs, and bread remain elevated

- Entertainment & Travel ✈️ – Demand keeps costs up

💡 Smart Tip: If you’re planning trips, check our guide on the cheapest days to fly in the US 2025 to save big.

🎯 Smart Money Moves to Make in September

You can’t control inflation, but you can control how you react. Here are proven steps:

- Refinance high-interest debt 💳 – Pay down credit cards first.

- Switch to discount shopping 🛒 – Take advantage of sales like the Adidas Summer Blowout Sale 2025.

- Automate savings 💰 – Even small amounts add up over time.

- Cut hidden subscriptions – Audit your monthly expenses.

- Invest smartly – Consider inflation-protected bonds or diversified ETFs.

🛍 Everyday Lifestyle Changes During US Inflation September 2025

Inflation isn’t just about charts — it’s about real-life tradeoffs families are making. The US inflation September 2025 numbers reveal why households are adjusting habits:

- Dining out 🍔 → More families are cooking at home.

- Streaming & Subscriptions 📺 → Many are cutting services or switching to cheaper bundles.

- Travel ✈️ → Vacation plans are shifting toward budget airlines and domestic trips.

- Shopping 🛒 → Discount retailers are gaining popularity as consumers seek deals.

👉 Example: See our guide on saving on streaming services for ways to reduce entertainment costs.

🙋 FAQs on US Inflation September 2025

Q1. What is the official US inflation September 2025 rate?

The official data for US inflation September 2025 will be released by the Bureau of Labor Statistics. Early forecasts suggest it may hover around 2.8%–3.0%.

Q2. How does US inflation September 2025 affect everyday costs?

Rising US inflation September 2025 impacts groceries, gas, rent, and utilities, making it more expensive for households to cover daily essentials.

Q3. Will the Federal Reserve cut rates after US inflation September 2025?

The Fed closely watches US inflation September 2025 numbers. If inflation cools, rate cuts could follow; if not, high borrowing costs may stay longer.

Q4. Why are housing and rent so high during US inflation September 2025?

Housing is a major driver of US inflation September 2025. Limited supply, higher mortgage rates, and strong demand are pushing costs upward.

Q5. How can I protect my budget from US inflation September 2025?

To fight US inflation September 2025, focus on cutting unnecessary expenses, refinancing debt, using money-saving apps, and building an emergency fund.

📝 Conclusion: Protecting Your Wallet in 2025

The US inflation September 2025 report is more than just a headline — it’s a signal for every American household. From the Federal Reserve’s next move to your grocery bill, the impacts are real.

👉 The good news? With smart planning, frugal choices, and informed financial strategies, you can stay ahead of inflation.

Start saving smarter today with SmartSaveUSA.com 💡