Saving money doesn’t have to feel overwhelming. With the 52-Week Savings Tracker, you can build a habit of setting aside a little cash each week and end up with a big reward at the end of the year. Pinterest has made this simple idea go viral by offering easy-to-use templates that inspire millions of users to start saving. Whether you’re planning for a vacation, building an emergency fund, or just want to challenge yourself financially, this trending template is the perfect place to start. 🚀

Table of Contents

What Is a 52-Week Savings Tracker? 💰

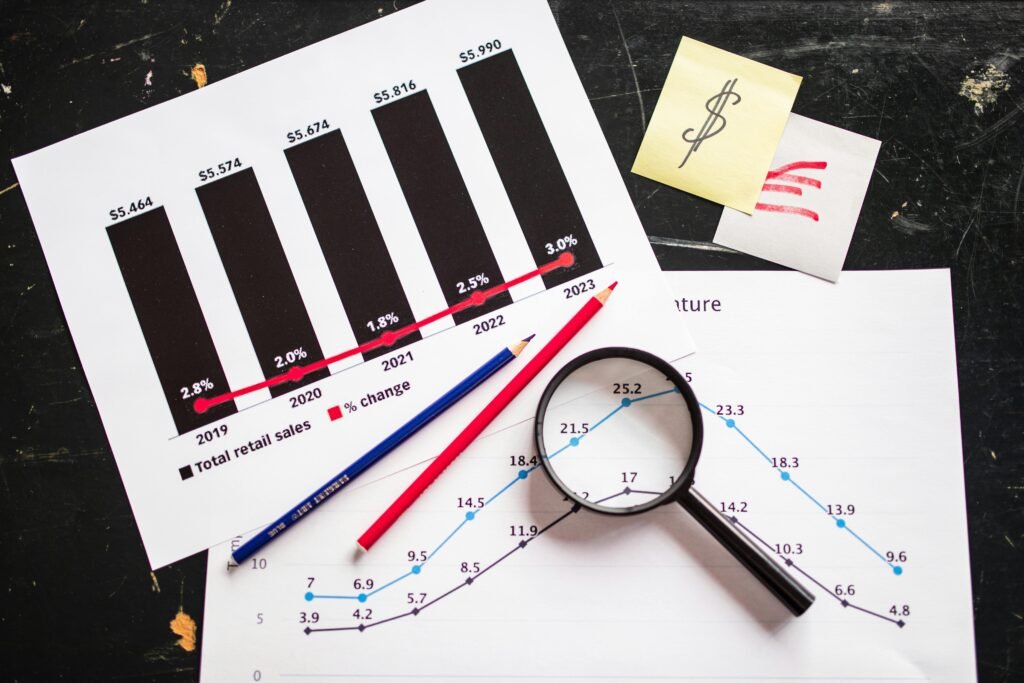

A 52-Week Savings Tracker is a simple plan where you save money every week for one year. Typically, you start small—like $1 in the first week—and increase the amount by $1 each following week. By week 52, you’ll be saving $52. At the end of the year, you’ll have saved $1,378.

Many people use templates or printable trackers to visualize their progress. Pinterest is full of beautifully designed versions that make saving fun and motivating. 🌟

Why Is the Pinterest 52-Week Savings Tracker So Popular? 📌

Pinterest is the go-to platform for inspiration, and financial planners have jumped in by sharing free templates that anyone can download. Here’s why they’ve become so popular:

- ✅ Visual Motivation – Colorful charts and printable designs make saving exciting.

- ✅ Easy to Use – Just print it, stick it on your fridge, or keep it in a planner.

- ✅ Customizable – Choose your starting amount or reverse the plan (start big, end small).

- ✅ Community Trend – Thousands of users share their progress, inspiring others.

Pinterest users love things that are both practical and visually appealing—and this tracker hits both.

Benefits of Using a 52-Week Savings Tracker 🎯

- Builds a Saving Habit 🏦

Saving weekly becomes a lifestyle. By the end of 52 weeks, it feels natural. - Flexible for Any Budget 💵

You can start with $1 or $10—it’s customizable based on your comfort. - Perfect for Goals 🎁

Whether it’s Christmas gifts, a trip, or debt payoff, the tracker helps you stay focused. - Boosts Motivation 💡

Watching your savings grow week after week is encouraging. - Family-Friendly 👨👩👧

Many families use it as a fun challenge, teaching kids about money.

How to Use the Pinterest 52-Week Savings Tracker 📖

- Download or Print the Template – Find one you like on Pinterest.

- Pick Your Method – Classic ($1 to $52) or Reverse ($52 down to $1).

- Set a Savings Spot – Use a jar, savings account, or an app.

- Mark Each Week – Color in your chart or tick the box.

- Stay Consistent – Schedule a reminder each week.

💡 Pro Tip: Automate your savings using your bank app so you don’t forget!

Variations of the 52-Week Savings Tracker 🔄

- Double Challenge: Save double each week and end with $2,756.

- Mini Challenge: Start with $0.50 and build slowly for beginners.

- Reverse Challenge: Save more in January when motivation is high, and less in December.

- Custom Goals: Adjust the tracker for a vacation, wedding, or emergency fund.

Pinterest has free templates for all these versions—you just need to pick the one that fits your lifestyle.

Why You Should Try It in 2025 🚀

With rising costs everywhere, small savings add up. The Pinterest 52-Week Savings Tracker Template isn’t just trendy—it’s practical. By the end of 2025, you could have over $1,000 set aside without even noticing the effort.

It’s not just about the money—it’s about building financial discipline and proving to yourself that consistent small steps create big results. 🌱

FAQs About the 52-Week Savings Tracker ❓

How much money do you save with a 52-week savings tracker?

With the standard method (saving $1 in week 1, $2 in week 2, etc.), you’ll save $1,378 in 52 weeks. Some people double the challenge to save $2,756.

Can I start the 52-week savings challenge anytime?

Yes! You don’t have to wait until January. You can begin the 52-Week Savings Tracker at any point in the year and still reach your savings goal.

What happens if I miss a week in the savings challenge?

No worries! You can catch up the next week, or adjust the amount to fit your budget. The tracker is flexible, so you don’t have to quit if you fall behind.

Can I do the 52-week savings tracker digitally?

Absolutely ✅. Many people use printable trackers from Pinterest, while others prefer Excel sheets, Google Sheets, or finance apps to track savings digitally.

What’s the best way to stay consistent with the 52-week savings tracker?

The easiest way is to automate your transfers through online banking. Pair that with a visual tracker (printable or digital), and set reminders so saving becomes a habit.

Final Thoughts 🌟

The Pinterest Trending 52-Week Savings Tracker Template is more than just a financial tool—it’s a lifestyle shift. With just a little consistency, you can save over $1,000 in a year. The visual templates keep you motivated, the challenge is fun, and the end result is financial freedom.

If you’re serious about saving, you’ll love exploring our other money-smart tips like how to save money on gaming consoles, take advantage of the Domino’s Pizza $3 deal, and jump on fun trends such as the TikTok pantry restock challenge.

For deal hunters, don’t miss the Amazon secret clearance picks of 2025—perfect for stretching your budget even further. And if travel is on your bucket list, check out TravelBuzz.us for affordable and trending U.S. travel ideas. ✈️🌎

So why wait? Head to Pinterest, grab your favorite 52-Week Savings Tracker, and start saving today. 💵✨