Gen Z Saving Secrets: The Surprising Way Millennials Save Smart

Generation Z — born roughly between 1997 and 2012 — is reshaping how America thinks about money. Unlike the millennials generation (1981–1996), who faced the Great Recession, Gen Zers entered adulthood with digital tools, side hustles, and a keen sense of financial independence.

💡 According to Forbes Finance, more than 70% of Gen Z are actively saving for emergencies, proving that this Gen Z generation is far more financially aware than their predecessors.

This shift shows that the Gen Z saving mindset is not just about putting money aside — it’s about saving smart and building long-term security.

Table of Contents

Why Gen Z Is Saving More Than Ever

Here’s what’s fueling the modern Gen Z money management trend:

- Economic Caution: Having grown up in uncertain times, young Americans saving money now see financial stability as freedom.

- Digital Banking: Apps like Chime, Revolut, and SoFi make digital banking for Gen Z effortless.

- Financial Literacy: Online influencers teach smart saving tips and budgeting on TikTok and YouTube.

- Minimalism: Less materialism, more mindfulness — Gen Z spends intentionally.

This generation uses saving apps and AI tools to track spending, automate savings, and invest micro-amounts, all from their phones.

How Millennials Paved the Way 👣

While Gen Z and millennials share similar financial values, their paths differ. The millennials generation endured economic turbulence but built the foundation for smarter money habits.

Their lessons helped generation Z approach finances with caution and clarity. Many millennials and Gen Z now align on saving early, avoiding debt, and investing digitally.

📈 For instance, NerdWallet highlights that millennials’ budgeting lessons have inspired Gen Z to prioritize financial literacy earlier than ever.

🔗 Internal Tip: Learn more about early saving with Retirement Savings by Age 30.

The Rise of Digital Banking for Gen Z 💳

Gen Z doesn’t visit banks — they log in. The Gen Z saving trend thrives on automation and app-based tools.

Popular digital banks like Ally, SoFi, and Chime help Gen Z manage accounts, earn high interest, and avoid fees. Features like “round-up savings” and instant transfers make managing money seamless.

💡 Example: Set up auto-savings so that every purchase is rounded up, turning spare change into future wealth.

To understand how interest rates impact your savings, read Federal Reserve Rate Cuts & Your Savings.

🏦 The Digital Banking Revolution Among Young Savers

The rise of digital banking has completely changed how younger generations handle money. Gone are the days of long bank lines and paper statements — now, everything fits in your pocket.

From Wells Fargo digital banking to TD digital banking and Santander digital banking, financial institutions have adapted fast to meet Gen Z’s expectations for speed and convenience.

Even digital only banks like Chime, SoFi, and Revolut attract the generation Z crowd with instant account setup, no-fee transactions, and real-time notifications. These platforms empower users to manage money smarter, helping both millennials and Gen Zers reach their financial goals faster.

💡 Did You Know? According to industry reports, over 80% of Gen Z prefer banks with online banking features over traditional options — showing that digital access is now the new standard.

🏦 Digital Banking for Every Generation

What’s exciting is that digital banking services aren’t just for Gen Z (age range 1997-2012) — even Generation X and millennials years (1981-1996) are embracing the trend. Platforms like First Citizens Digital Banking, Digital Federal Credit Union Customer Service, and FNB Digital Banking now support both personal and online small-business banking, giving users more control over money than ever before.

Whether you’re managing a side hustle or checking your balance through First Tennessee Banking Online or Digital First Bank, the convenience of mobile access keeps savings and investments just a tap away. Across all age groups — Gen Z, millennials, and Generation X — the digital revolution in banking continues to redefine what financial freedom really means.

Millennials Walked, So Gen Z Could Run 🏃♂️

When we compare millennials generation years to Gen Z years, it’s clear that Gen Z took their predecessors’ financial lessons and digitized them.

| Financial Habit | Millennials | Gen Z |

|---|---|---|

| Budgeting | Spreadsheets & journals | Automated finance apps |

| Saving Focus | Emergency funds | Emergency + investment |

| Spending Mindset | Experiences | Purpose-driven |

| Tech Usage | Online banking | Fintech-first |

🔗 CNBC Personal Finance reports that Gen Z invests earlier and saves faster due to accessible fintech apps — proving that digital literacy = financial literacy.

💡 Smart Saving Habits Every Young American Should Master

The power of Gen Z saving comes from small, consistent habits that grow over time. Today’s young Americans saving money aren’t waiting for higher salaries — they’re mastering money through awareness, tools, and discipline.

One major shift in gen z money management is automation. From auto-transfers to round-up features, everything happens behind the scenes — helping users save without thinking.

Here are a few smart saving tips that define this generation’s success:

- Set automatic transfers to savings right after payday.

- Use digital banking for Gen Z apps that offer high-interest savings and instant tracking.

- Keep short-term and long-term goals in separate accounts.

- Review your budget weekly — financial clarity builds confidence.

💬 The best part? Gen Z doesn’t just save money — they save with purpose. Whether for travel, investing, or independence, this generation’s disciplined approach proves that small steps can lead to major financial freedom.

The Hidden Psychology of Saving Smart 🧠

Behind every smart saving tip lies a shift in mindset. For Gen Z, saving isn’t about deprivation — it’s empowerment.

They don’t see budgeting as restrictive; they see it as control. That’s why platforms like Acorns and Robinhood attract millions of generation zed users looking to grow wealth effortlessly.

Here’s how generation millennials age range influenced them:

- Treat saving as a form of self-care.

- Make small, consistent deposits.

- Prioritize mental peace over luxury spending.

Want to see how external forces like inflation shape this behavior? Check out Bankrate for in-depth financial trends and data.

Gen Z’s Smart Saving Tools 🔧

Here are the favorite tools of Gen Zers for saving smart and tracking money:

- Mint & YNAB: For automated expense tracking.

- Acorns: Invest spare change automatically.

- Chime: Set up recurring auto-savings from paychecks.

- SoFi: Combine savings, investing, and budgeting in one app.

These apps empower gen millennial and gen z milenial users alike to plan, save, and invest efficiently — bridging the gap between generation zed and millennials generation.

Everyday Saving Hacks Gen Z Swears By 💸

Let’s face it — Gen Z knows how to save smart without missing out on fun.

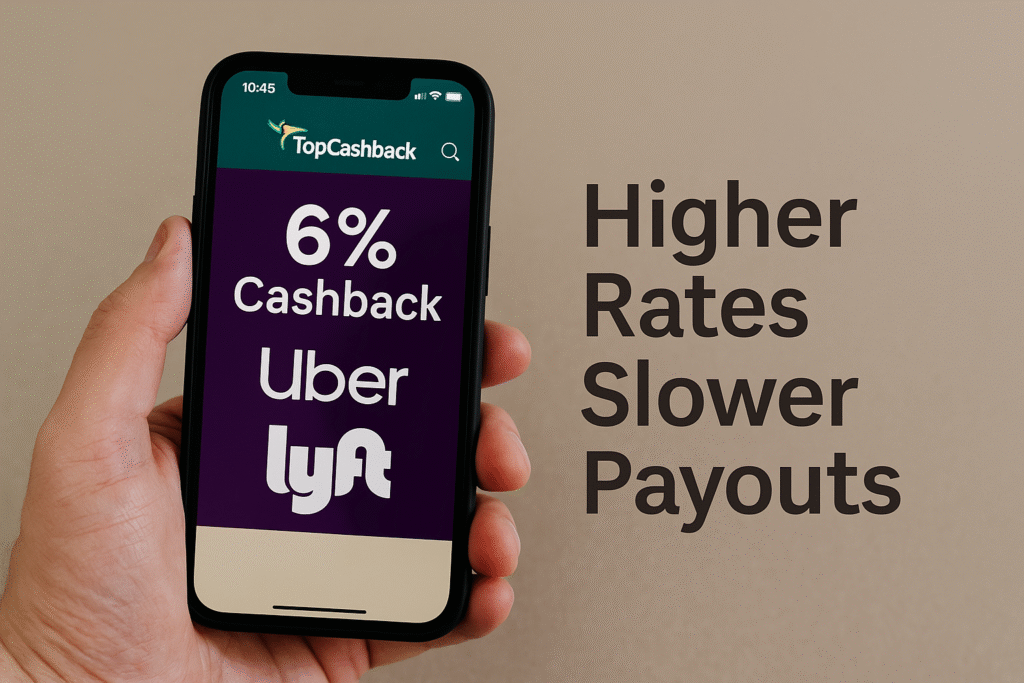

- Use cashback apps for every online purchase.

- Track expenses weekly with digital planners.

- Split bills automatically through Venmo or PayPal.

- Take advantage of student discounts everywhere.

💡 Want to uncover hidden retail secrets? Read Costco Price Tag Secrets & Savings to learn how to decode deals and stretch your budget.

For additional practical insights, explore Money Under 30 — an amazing resource for young Americans saving money and understanding early investing.

Future of Gen Z Saving 🌍

The age range for Gen Z may be young, but their financial intelligence is far beyond their years. With access to AI budgeting tools, crypto investing platforms, and financial education, this Z generation age range is redefining wealth.

The next decade will see genx generation, millennials, and Gen Z blending values — from digital investments to sustainable finance.

💚 The core idea remains timeless: start small, stay consistent, and focus on long-term freedom.

Frequently Asked Questions About Saving & Money Habits

Q1. How much money should I keep in my savings account?

Most financial experts recommend keeping enough to cover three to six months of living expenses, so you’re ready for emergencies without relying on credit.

Q2. What’s the smartest way to start saving if I live paycheck to paycheck?

Start small even $10 or $20 a week. Automate transfers to your savings right after payday so you save before you spend.

Q3. Why does it feel so hard to save money even when I’m earning enough?

Because spending is emotional. Subscriptions, convenience purchases, and lifestyle upgrades add up quietly. Tracking every expense helps you regain control.

Q4. Is it better to save money or pay off debt first?

Generally, pay off high-interest debt first (like credit cards), while still keeping a small emergency fund. That balance protects you from future debt.

Q5. How can I build better money habits that actually last?

Start by setting clear goals, tracking progress, and rewarding yourself for consistency. Good habits stick when they feel rewarding, not restrictive.

Final Thoughts 💭

Gen Z saving is more than a money trend — it’s a lifestyle movement built on awareness, technology, and independence.

So whether you belong to generation millennials age range, age group for millennials, or the age range for Gen Z, the rule is the same: save smart today, live free tomorrow. 🌟