Gen-Z Investors: Why They’re Ditching Savings Accounts in 2025

Traditional savings accounts are losing their grip on America’s youngest investors. While previous generations relied heavily on savings accounts and CDs, Gen-Z Investors are reshaping the financial landscape in ways that would have been unimaginable just a decade ago.

The most popular choices among Gen-Z Investors include micro-investing apps, cryptocurrency platforms, and tax-advantaged retirement accounts.

As of 2025, young Americans between ages 18-27 are increasingly choosing investment platforms over traditional bank products. This shift isn’t just a trend—it’s a fundamental change in how an entire generation approaches wealth building. Gen-Z Investors are leading this financial revolution.

Table of Contents

Why Gen Z is Abandoning Traditional Savings Accounts

The Low-Return Reality Check

Despite high-yield savings rates hovering around 4-5% APY in 2025, Gen Z investors see these returns as insufficient for their long-term goals. When inflation averages 2-3% annually, a 4% savings account barely keeps pace with rising costs.

Consider this: $1,000 in a traditional savings account earning 0.01% APY (the national average) would grow to just $1,001 after a year. Meanwhile, that same $1,000 invested in index funds has historically averaged 10% annual returns over the long term.

Sarah Chen, a 24-year-old marketing coordinator from Austin, Texas, explains: “I realized my money was essentially losing value sitting in my Wells Fargo savings account. I moved 80% of my emergency fund to investments and kept only three months of expenses in cash.”

Digital-First Financial Education

Gen Z has grown up with unprecedented access to financial education through:

- YouTube channels like Graham Stephan and Andrei Jikh

- TikTok financial influencers breaking down complex concepts

- Micro-investing apps that gamify the investment process

- Podcast content from The Ramsey Show and Choose FI

This digital-native generation doesn’t rely on traditional bank advisors. Instead, they educate themselves through social media and online resources, leading to more informed investment decisions at younger ages. Gen-Z Investors consistently choose growth-oriented strategies over traditional banking products.

The Inflation Hedge Mentality

Unlike previous generations who viewed savings accounts as safe havens, Gen Z understands that cash loses purchasing power over time. They’ve witnessed:

- Housing prices increase 40% in many markets since 2020

- Grocery costs rise significantly due to supply chain issues

- Student loan debt averaging $37,000 per graduate in 2025

This economic reality has pushed them toward assets that historically outpace inflation: stocks, real estate investment trusts (REITs), and even cryptocurrency investments. Smart Gen-Z Investors understand these assets consistently outperform traditional banking products.

Top Gen Z Investing Alternatives to Savings Accounts

1. Roth IRA: The Tax-Free Growth Champion

Roth IRA benefits make this account type particularly attractive for young investors. Unlike traditional IRAs, Roth contributions are made with after-tax dollars, but withdrawals in retirement are completely tax-free.

Key advantages for Gen Z:

- No required minimum distributions

- Contributions can be withdrawn penalty-free anytime

- Tax-free growth potential over 40+ years

- 2025 contribution limit: $7,000 annually

Real-world example: Marcus, a 23-year-old software developer in Seattle, maxes out his Roth IRA annually. “I contribute $583 per month automatically. At 7% average returns, I’ll have over $1.8 million by retirement—all tax-free.”

2. Micro-Investing Platforms: Small Dollars, Big Impact

Micro-investing apps have revolutionized how young Americans start their investment journey:

Popular platforms include:

- Acorns: Rounds up purchases and invests spare change

- Stash: Allows fractional share investing with $5 minimums

- Robinhood: Commission-free trading with educational content

These apps remove traditional barriers like high minimum investments and complex interfaces. Emma Rodriguez, a 22-year-old college student, started with just $25: “I use Acorns to invest my coffee money. What used to be $150 monthly at Starbucks now grows in my investment account.”

3. Exchange-Traded Funds (ETFs): Diversification Made Simple

Gen Z gravitates toward ETFs because they offer instant diversification without requiring extensive research. These Gen Z investing alternatives provide professional-level portfolio management at low costs. Popular choices include:

- SCHD: Schwab US Dividend Equity ETF

- VTI: Vanguard Total Stock Market ETF

- QQQ: Invesco QQQ Trust (Nasdaq tracking)

Learn more about ETFs vs mutual funds here

4. Target-Date Funds: Set-and-Forget Investing

These funds automatically adjust risk levels as investors approach retirement. For Gen Z, target-date funds like Vanguard Target Retirement 2065 provide:

- Professional portfolio management

- Automatic rebalancing

- Age-appropriate risk allocation

- Low expense ratios (typically 0.15% or less)

5. Cryptocurrency: The High-Risk, High-Reward Play

Despite volatility concerns, cryptocurrency investments remain popular among young investors. Recent data shows 42% of Gen Z investors own crypto—nearly four times higher than those with retirement accounts.

Popular crypto strategies:

- Dollar-cost averaging into Bitcoin and Ethereum

- Using platforms like Coinbase and Kraken

- Allocating 5-10% of portfolios to digital assets

Important note: Financial experts recommend limiting crypto exposure to money you can afford to lose entirely.

The 2025 Investment Landscape: What’s Changed

Rising Interest Rates Impact

The Federal Reserve’s monetary policy decisions have created unique opportunities. Current Fed rate changes affect both savings rates and investment valuations.

Current environment benefits:

- Money market funds offering 4-5% yields

- I Bonds providing inflation protection

- Real estate investment opportunities due to market corrections

Technology-Driven Accessibility

Investment platforms have eliminated traditional barriers:

- Zero-commission trading at most brokerages

- Fractional shares allowing investment in expensive stocks like Amazon or Tesla

- Robo-advisors providing portfolio management for 0.25% annual fees

- Educational content integrated into investment apps

These technological advances make investing more accessible for Gen-Z Investors than traditional wealth-building methods.

ESG and Impact Investing Focus

Environmental, Social, and Governance (ESG) investing appeals to Gen Z’s values-driven approach. Popular ESG options include:

- Vanguard ESG U.S. Stock ETF (ESGV)

- iShares MSCI USA ESG Select ETF (SUSA)

- Sustainable impact bonds

Smart Strategies: Balancing Safety and Growth

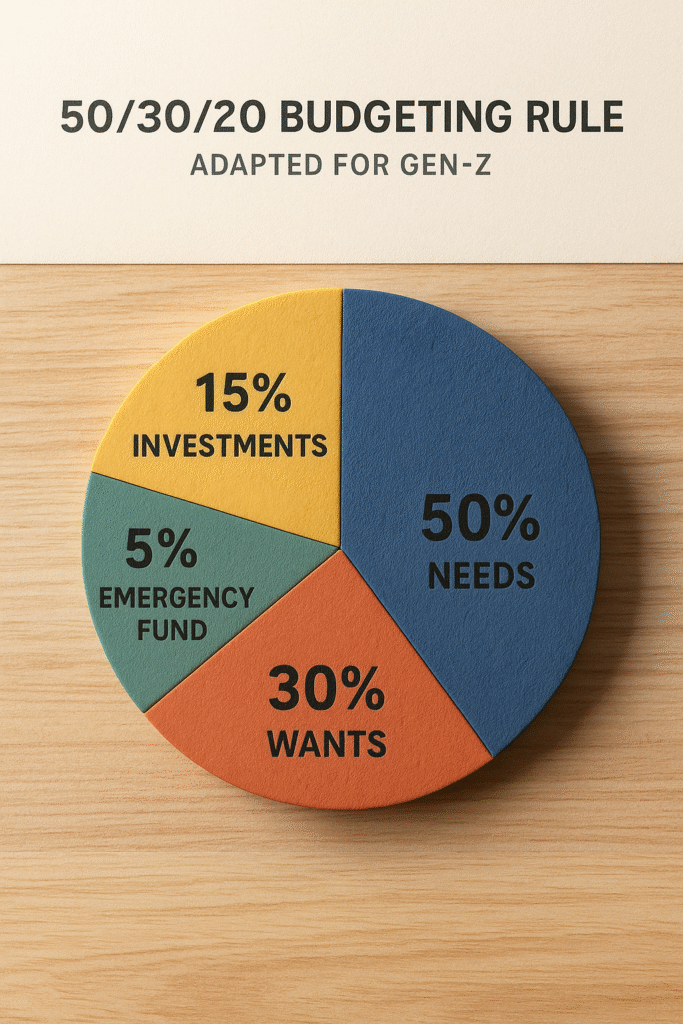

The 50/30/20 Modified Approach

Traditional budgeting advice suggests 20% savings, but Gen-Z Investors require a modified approach to maximize growth potential:

- 50% needs (rent, groceries, utilities)

- 30% wants (entertainment, dining out)

- 15% investments (stocks, ETFs, Roth IRA)

- 5% emergency fund (high-yield savings)

Emergency Fund Evolution

Instead of keeping 6 months of expenses in low-yield savings, many young investors use a tiered approach:

Tier 1: 1 month expenses in checking account Tier 2: 2 months in high-yield savings Tier 3: 3+ months in stable, liquid investments (money market funds, short-term bonds)

Taking Advantage of Employer Benefits

Gen Z workers increasingly maximize employer-sponsored benefits:

- 401(k) matching: Free money that shouldn’t be ignored

- Health Savings Accounts (HSAs): Triple tax advantage for medical expenses

- Employee Stock Purchase Plans: Discounted company stock options

Maximize your workplace benefits with our Wells Fargo bonus guide

Common Mistakes to Avoid

Over-Concentration in Trendy Investments

While cryptocurrency investments and meme stocks grab headlines, financial experts recommend limiting speculative investments to 5-10% of total portfolios.

Neglecting Emergency Funds Entirely

Despite favoring investments, maintaining some liquid cash remains crucial. Unexpected expenses like car repairs, medical bills, or job loss require immediate access to funds.

Emotional Trading

Social media-driven investment decisions often lead to buying high and selling low. Successful young investors focus on:

- Consistent monthly contributions

- Long-term thinking (20+ year horizons)

- Ignoring daily market fluctuations

2025 Tax Advantages Young Investors Shouldn’t Miss

Roth IRA Contribution Strategies

The 2025 income limits for Roth IRA contributions are:

- Single filers: Full contribution up to $138,000 AGI

- Married filing jointly: Full contribution up to $218,000 AGI

Young investors earning less than these thresholds should prioritize Roth contributions over traditional savings.

Tax-Loss Harvesting

Even in taxable accounts, Gen Z investors can reduce tax burdens through strategic selling of losing positions to offset gains.

Building Wealth Beyond Traditional Banking

Real Estate Investment Trusts (REITs)

REITs provide real estate exposure without requiring large down payments:

- Realty Income (O): Monthly dividend payments

- Vanguard Real Estate ETF (VNQ): Broad real estate exposure

- Real estate crowdfunding: Platforms like Fundrise and RealtyMogul

International Diversification

Global investing provides additional growth opportunities:

- VTIAX: Vanguard Total International Stock Index

- VXUS: Vanguard Total International Stock ETF

- Emerging markets exposure through funds like VWO

Technology Tools Revolutionizing Gen Z Investing

Automated Investment Features

Modern platforms offer sophisticated automation:

- Auto-rebalancing: Maintains target asset allocation

- Dividend reinvestment: Compounds returns automatically

- Goal-based investing: Links investments to specific objectives

Social Trading and Education

Investment apps now include:

- Paper trading: Practice with virtual money

- Community features: Learn from other investors

- Educational content: Integrated learning modules

The Psychology Behind the Shift

Risk Tolerance and Time Horizon

Gen Z’s 40+ year investment timeline allows for higher risk tolerance. Young investors can weather market volatility because they won’t need the money for decades.

Instant Gratification Meets Long-Term Thinking

While stereotyped as seeking instant gratification, Gen Z demonstrates remarkable long-term thinking regarding investments. They understand compound interest and are willing to sacrifice short-term accessibility for long-term growth.

Financial Independence Mindset

The FIRE (Financial Independence, Retire Early) movement resonates strongly with Gen Z. Many aim to accumulate 25 times their annual expenses to achieve financial independence by age 40-50.

Practical Action Steps for Gen Z Investors

Month 1: Foundation Building

- Open a high-yield savings account for emergencies

- Research and open a Roth IRA

- Set up automatic transfers from checking to investment accounts

Month 2: Investment Selection

- Choose broad market index funds (VTI, VTIAX)

- Start with target-date funds if overwhelmed by choices

- Enable automatic dividend reinvestment

Month 3: Optimization

- Increase contribution percentages as income grows

- Review and rebalance quarterly

- Add international exposure for diversification

Ongoing: Education and Adjustment

- Read financial books like “The Simple Path to Wealth”

- Follow reputable financial news sources

- Adjust strategies based on life changes

Expert Recommendations for 2025

Financial advisors specifically recommend Gen Z investors focus on:

Low-Cost Index Fund Investing

- Expense ratios under 0.20%

- Broad market exposure

- Consistent contributions regardless of market conditions

Maximizing Tax-Advantaged Accounts

- Prioritize Roth IRA over taxable investing

- Utilize employer 401(k) matching

- Consider HSA contributions for triple tax benefits

Maintaining Some Liquidity

- Keep 1-3 months expenses in high-yield savings

- Use money market funds for medium-term goals

- Avoid tying up all money in illiquid investments

The Future of Gen Z Wealth Building

Technological Integration

Investment platforms continue evolving with features like:

- AI-powered portfolio optimization

- Cryptocurrency integration in traditional brokerages

- Social investing through platforms like eToro

Regulatory Changes

Potential 2025 developments include:

- Expanded retirement account contribution limits

- New cryptocurrency regulations

- Enhanced consumer protection for digital investments

Frequently Asked Questions

Q1. Should Gen-Z completely stop using savings accounts?

No. Financial experts recommend keeping 1–3 months of expenses in a high-yield savings account for emergencies. The rest can be invested in growth-focused assets like index funds, ETFs, or Roth IRAs to beat inflation and build long-term wealth.

Q2. How much should Gen-Z save vs. invest each month?

A popular rule is the 15/5 Rule:

15% for investments (ETFs, Roth IRA, index funds)

5% for emergency savings in high-yield accounts

Adjust based on your income, goals, and risk tolerance.

Q3. Are micro-investing apps like Acorns and Stash worth it?

Yes, especially for beginners. These apps allow fractional investing with as little as $5, automate contributions, and provide basic financial education. As your balance grows, you can switch to low-cost brokerage platforms for fewer fees.

Q4. How much should Gen-Z invest in cryptocurrency?

Experts suggest limiting crypto exposure to 5–10% of your portfolio because of its high volatility. Focus on Bitcoin and Ethereum if you’re starting, and always diversify with safer assets like ETFs or Roth IRAs.

Q5. When should Gen-Z start investing instead of just saving?

As soon as you have an emergency fund of $1,000–$2,000 in place, start investing early to maximize compound interest benefits. Time in the market matters more than timing the market.

Conclusion: Building Wealth the Smart Way in 2025

Smart Gen-Z Investors represent a fundamental shift toward growth-oriented wealth building. While traditional savings accounts serve important purposes, they shouldn’t be the primary vehicle for long-term financial goals.

The combination of low fees, educational resources, and technological innovation has created unprecedented opportunities for young investors. By starting early and staying consistent, Gen-Z Investors can build substantial wealth through strategic investing.

The key is balance: maintain emergency liquidity in high-yield savings rates while aggressively pursuing investment strategies. With proper planning and patience, today’s Gen-Z Investors can achieve financial independence far earlier than previous generations.

Ready to optimize your financial strategy? Start saving smarter with SmartSaveUSA.com and discover personalized investment approaches that align with your goals and risk tolerance.

Learn More:

- U.S. Securities and Exchange Commission – For investment education and regulatory information

- Federal Reserve Economic Data – For current interest rate data and economic statistics

- IRS.gov – For retirement account contribution limits and tax information