Introduction: Saving Money in the USA Just Got Smarter

As of 2025, inflation, rising utility bills, and higher grocery costs at places like Walmart and Costco have many Americans looking for better money-saving tips USA residents can trust. A new fintech app helps Americans save automatically, bringing smart finance hacks and automated budgeting tools to households nationwide. This technology makes saving money in the US effortless no spreadsheets, no complicated budgets, just real results.

In this post, we’ll explore how this app works, real-life examples from American users, and practical ways to combine it with frugal living USA strategies for maximum savings.

Table of Contents

How the New Fintech App Helps Americans Save Automatically

This latest fintech app links directly to your checking account, analyzes your spending, and automatically transfers small amounts into a savings account—so you save without thinking about it.

Why Automation Matters in 2025

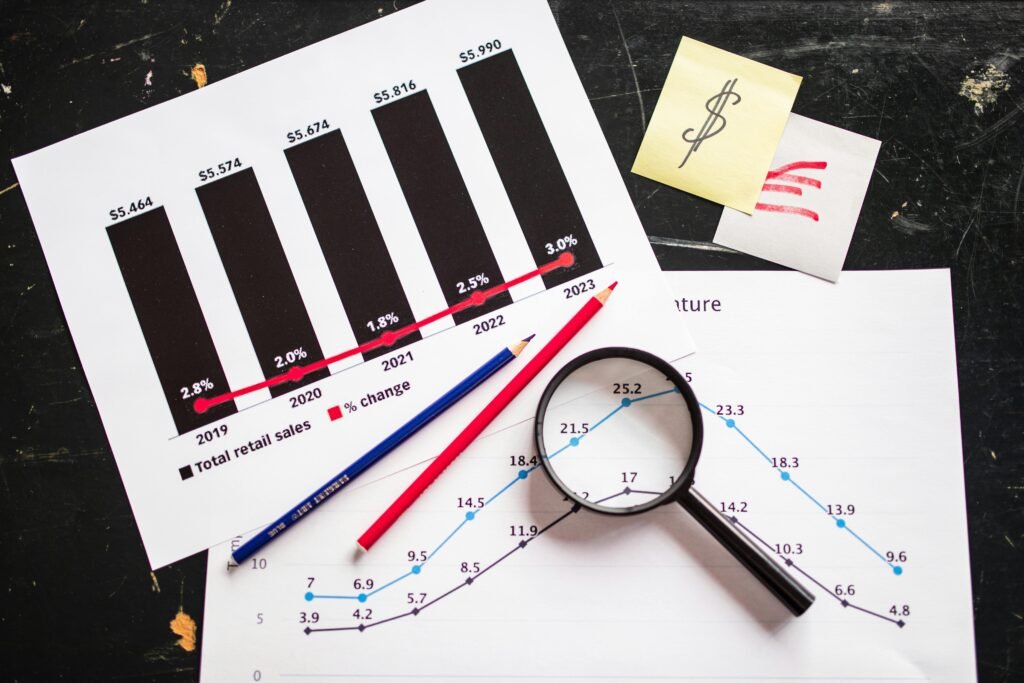

According to the U.S. Bureau of Economic Analysis, personal savings rates in the USA have dropped to nearly 3.5% in late 2024, one of the lowest levels in decades. Many Americans simply forget to save or feel they don’t have enough left at the end of the month.

This app removes that barrier by:

- Analyzing Spending Patterns: Tracks your transactions at major retailers like Walmart, Costco, and Amazon.

- Micro-Saving Transfers: Moves as little as $1–$5 to savings after every purchase.

- Budget-Friendly Alerts: Helps you avoid overspending while still saving money in the US.

Key Features: Smart Finance Hacks for US Households

1. Automatic Round-Ups and Micro-Savings

Every time you swipe your debit or credit card, the app rounds up to the nearest dollar and saves the difference. For example:

- Spend $23.50 at Costco → App saves $0.50 automatically.

- Pay a $78.20 utility bill → App saves $0.80 automatically.

It doesn’t sound like much, but over a month, this can add up to $50–$100 without any effort.

2. Budgeting Tools with AI Insights

Unlike old-school budgeting apps, this fintech tool uses AI to:

- Predict your upcoming bills like internet, insurance, and electricity.

- Suggest areas to cut back, like unused streaming services.

- Provide custom frugal living USA recommendations.

Quick Tip: Try linking the app with cashback credit cards or best bank bonuses in the US to double your savings potential.

3. Smart Goals for Emergency Funds

The app lets you set goals like:

- “Save $1,000 for an emergency fund.”

- “Build $500 for holiday shopping at Walmart.”

It automatically adjusts transfers to help you reach these targets on time.

Real-Life Example: The Johnson Family in Texas

The Johnsons, a middle-class family in Dallas, used the app for three months. Here’s what happened:

- Initial Savings: $0 in dedicated savings.

- Average Monthly Income: $5,000 after taxes.

- Savings After 3 Months: $420 automatically saved.

Mrs. Johnson said, “We didn’t even feel the money leaving our account—it just grew quietly in the background.”

Why Americans Need This App in 2025

Inflation and Rising Costs

According to the U.S. Department of Labor, grocery prices increased 2.7% in 2024, while utility bills rose nearly 3.2%. That means budgeting and saving money in the US has never been more critical.

Growing Demand for Frugal Living USA

Searches for “frugal living tips USA” grew by 40% on Google in 2024. Americans want:

- Automated savings tools

- Smart finance hacks for daily life

- Practical ways to stretch every dollar

This app combines all three into one simple platform.

How to Maximize Savings with This App

Step 1: Link All Your Accounts

Connect your main checking, credit card, and even your smart home gadgets that save money to track expenses more accurately.

Step 2: Activate Automatic Savings

Turn on round-ups, bill predictions, and goal-based saving.

Step 3: Apply Money-Saving Tips USA Style

Combine the app with these hacks:

- Use Coupons: Walmart, Costco, and Kroger often offer digital coupons.

- Cut Recurring Costs: Audit subscriptions like Netflix or gym memberships.

- Take Advantage of shopping deals: Stack cashback apps with in-store promotions.

Step 4: Track Your Progress

The app provides weekly and monthly reports so you can celebrate milestones—like saving your first $500 without even noticing.

Additional Smart Finance Hacks for 2025

- Utility Savings: Many states offer rebates for energy-efficient appliances (Energy.gov).

- National Park Pass: Save on family trips with a National Park Pass.

- Bank Bonuses: Check out banks offering $200–$500 bonuses for new accounts in 2025.

Expert Opinion: Why Automatic Saving Works

Finance expert Sarah Lopez from the University of Michigan explains:

“Behavioral finance studies show that automating savings reduces decision fatigue. People save more when they don’t have to think about it.”

2025 Trends: The Future of Automated Saving in the US

- AI Budgeting Tools: More banks now integrate AI-powered financial assistants.

- Cashback + Automatic Savings: Credit card companies like Chase and Capital One are experimenting with linked savings rewards.

- Frugal Living Apps: Expect more apps combining coupons, budgeting, and automation in one place.

For more trending tips, check out SmartSaveUSA’s latest guides.

Top 5 FAQs Fintech app helps Americans save automatically

Q1. How does a fintech app help Americans save automatically?

A fintech app helps Americans save automatically by linking to your bank account, analyzing your spending, and moving small amounts of money into savings without you even noticing. It turns everyday purchases into simple savings opportunities.

Q2. Is the fintech app safe for saving money in the US?

Yes. Any reputable fintech app helps Americans save automatically using bank-level security and encryption. Most also follow strict U.S. financial regulations to protect your data and funds.

Q3.Can I set my own savings goals with this fintech app?

Absolutely! A good fintech app helps Americans save automatically while letting you set personal goals like a $1,000 emergency fund or a summer vacation budget so you stay on track.

Q4.What makes this fintech app better than traditional budgeting tools?

Unlike manual spreadsheets or old-school budgeting apps, the fintech app helps Americans save automatically by using AI insights, round-ups, and real-time analytics so you can save without extra work.

Q5.How much can the average person save with this fintech app?

Most users report saving $50–$100 per month effortlessly. Over a year, this fintech app helps Americans save automatically and build up hundreds even thousands without feeling the pinch.

Conclusion: Start Saving Smarter Today

The new fintech app helps Americans save automatically by turning small, everyday transactions into real savings. With rising costs and economic uncertainty, tools like this are becoming essential for families across the USA.

Ready to save smarter? Explore more money-saving tips at SmartSaveUSA.com and start building your financial future today.