Emergency Fund: Don’t Lose Money Earn 4%+ Interest

If you’ve ever had to swipe your credit card in an emergency, you already know the stress of not having an emergency fund. But here’s the truth: simply having one isn’t enough anymore. With inflation eating away at your savings, your money could be silently losing value every month.

The good news? You can protect your cash and make it grow all by choosing the right high yield savings account that earns 4%+ interest.

Let’s break it down step by step 👇

Table of Contents

Why an Emergency Fund Matters More Than Ever 🚨

Life is unpredictable — job loss, medical bills, car repairs — you name it. Experts like Investopedia recommend saving 3 to 6 months’ worth of expenses in an emergency fund.

Here’s why it’s your ultimate financial safety net:

- 🏠 Prevents debt: You won’t have to rely on credit cards or loans.

- 💳 Improves peace of mind: You can handle unexpected costs without panic.

- 📈 Protects financial goals: You stay on track for investing, travel, or retirement.

But leaving that money in a regular savings account with near-zero interest rates is like hiding cash under your mattress.

The Hidden Cost of Low-Interest Savings Accounts 💸

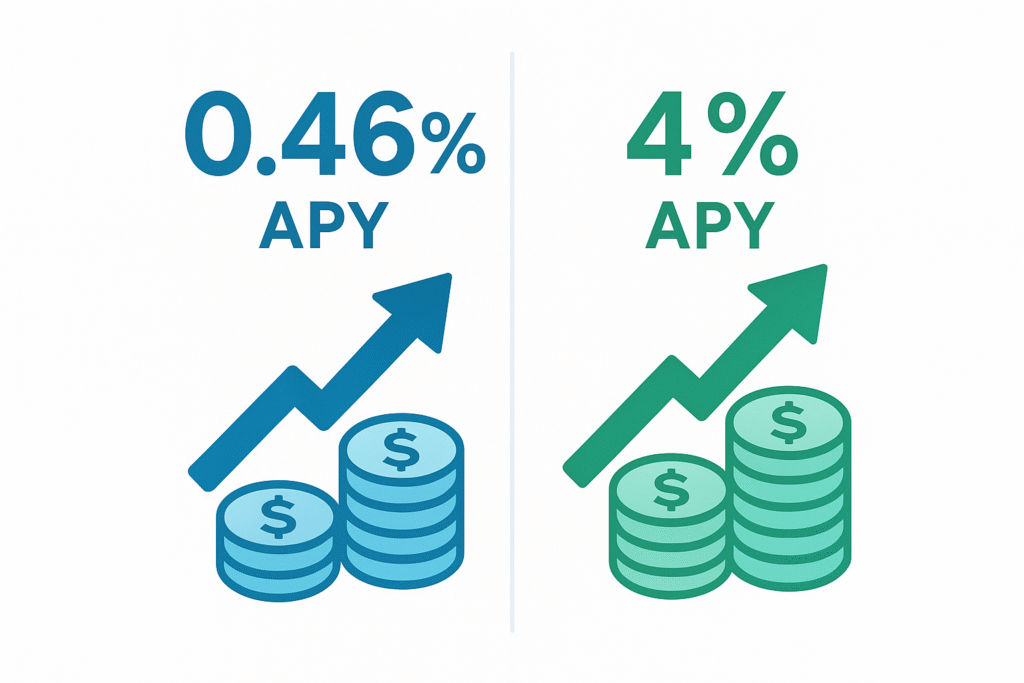

According to Forbes, the national average savings account interest rate is only around 0.46%.

That means your $10,000 emergency fund earns just $46 a year — while inflation averages 3–4%. Essentially, you’re losing purchasing power over time.

That’s why switching to a high yield savings account or online savings account is the smarter move. Many banks now offer 4%+ annual percentage yield (APY) — nearly 10x higher than traditional banks.

How to Build a High-Yield Emergency Fund 🏦

Creating a high-yield emergency fund isn’t complicated — it just requires a plan.

Step 1: Set Your Goal

Calculate how much you’d need to cover 3–6 months of expenses. If your monthly budget is $2,000, aim for $6,000–$12,000.

Step 2: Choose the Right Account

Look for an FDIC-insured high yield savings account or money market account with:

- 4%+ interest rates savings accounts

- No monthly fees

- Easy withdrawals

- Strong online access

Check out this helpful guide on High-Yield Savings Accounts for expert recommendations.

Step 3: Automate Your Savings

Set up automatic transfers from your checking account each payday. Even $100 a week can grow into thousands over time.

Step 4: Keep It Separate

Don’t mix your emergency fund with your spending account. Keeping it separate prevents impulse withdrawals and helps you stay disciplined.

Where to Park Your Emergency Fund Safely 🔐

Let’s explore your best options for keeping your emergency fund both accessible and profitable:

1. High-Yield Online Savings Accounts

Top online banks like Ally, Barclays, and Marcus by Goldman Sachs offer high interest savings accounts with APYs above 4%.

Some even provide joint bank accounts, kids savings accounts, and business savings accounts — perfect if you’re saving for family or company expenses.

2. Certificates of Deposit (CDs)

If you don’t need instant access, consider a certificate of deposit.

CDs offer higher rates than typical savings accounts — sometimes over 5%, depending on the term.

Compare your options here: CDs vs High-Yield Savings 2025.

3. High-Interest Money Market Accounts

These are a blend of checking and savings — giving flexibility and high rates. Many online banks offer tax free savings account variants for specific goals.

4. Credit Union & Community Banks

Some credit union savings accounts offer better savings interest rates and lower fees. Check Navy Federal, PNC Bank, and Wells Fargo for competitive options.

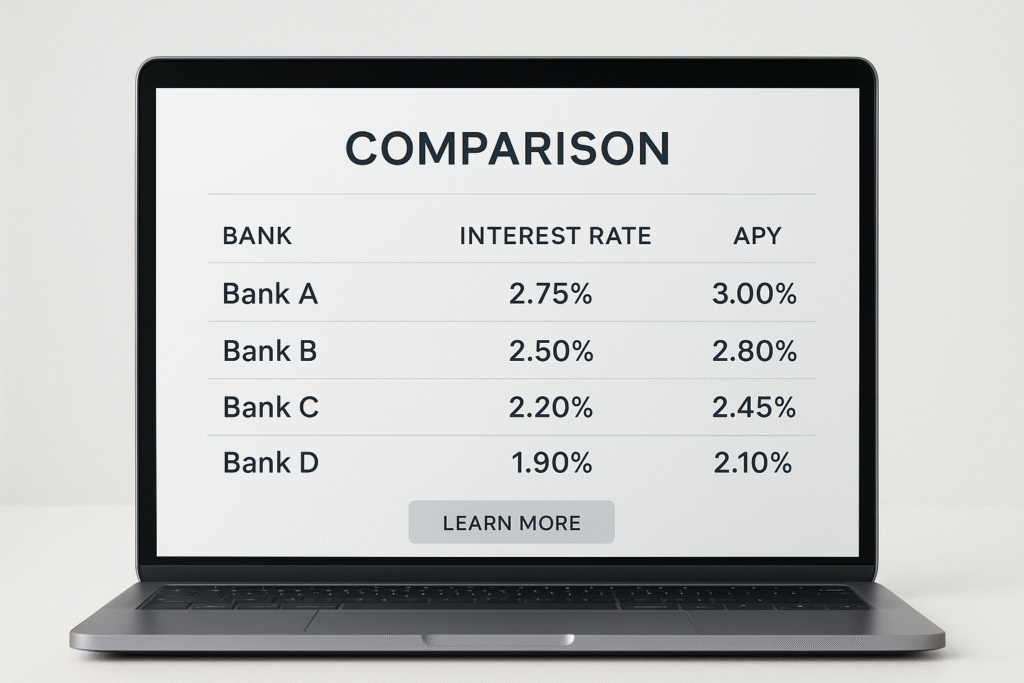

Pro Tip: Compare the Banks with the Highest Interest Rates 🏁

Don’t settle for average returns. Compare offers from:

- Bankrate – Updated daily rates from top U.S. banks

- NerdWallet – Expert reviews and APY comparisons

- FDIC – Verified federal savings rate data

These platforms help you find banks with highest interest rates, including Citibank, Capital One, American Express Personal Savings, and PNC Savings Account.

The Surprising Link Between Interest Rates and Mortgages 🏠

Did you know rising interest rates also affect your home loans?

When the Federal Reserve raises rates, mortgage and savings rates often move together. That’s why your emergency fund might benefit from these changes.

Read this breakdown: How Mortgage Rates Rise & Fall — and Their Surprising Impact.

Other Smart Ways to Grow Your Money 🌱

Aside from your emergency fund, you can explore:

- High yield CD accounts (great for long-term goals)

- 529 plans for children’s education

- Joint or child savings accounts to teach financial habits early

- High interest business savings accounts for entrepreneurs

Even Apple Bank, Wells Fargo, and Citi are improving their online savings account offerings.

Pro tip: Look for accounts with a strong annual percentage yield (APY) and no hidden fees.

Avoid These Common Emergency Fund Mistakes ⚠️

- ❌ Keeping too little: Start small, but aim for full coverage.

- ❌ Investing your emergency fund: It must stay liquid and risk-free.

- ❌ Ignoring rate changes: Reassess every 6 months to ensure you’re earning the best bank interest rates.

- ❌ Mixing funds: Don’t merge your emergency fund with your investment or travel funds.

💭 The Psychology of Saving

Saving money isn’t just about numbers — it’s about mindset. Many people struggle to save consistently because they view it as a sacrifice instead of a reward. Try reframing it: every dollar you save buys you freedom and peace of mind. When you think of saving as an act of self-care rather than restriction, it becomes a habit you’ll actually enjoy.

🧘The Peace of Mind That Comes with Preparedness

There’s nothing quite like the calm that comes from knowing you’re ready for whatever life throws your way. Whether it’s a surprise bill or a sudden job change, having money set aside gives you control in uncertain times. That confidence spills into every part of your life — your health, your relationships, and your decision-making. True financial freedom isn’t about being rich; it’s about being secure.

📝 Frequently Asked Questions (FAQs)

Q1. How much money should I keep in my emergency savings?

Most financial experts recommend saving enough to cover three to six months of living expenses. This helps you stay financially stable if you lose your job or face unexpected costs.

Q2. Where’s the safest place to keep emergency savings?

The safest option is a federally insured account at a bank or credit union. These accounts protect your money up to $250,000 per depositor through federal insurance programs.

Q3. Should I invest my emergency fund?

It’s generally best not to invest it. Emergency funds should stay in accounts that are easy to access and free from market risk. The goal is safety and liquidity, not high returns.

Q4. When should I use my emergency savings?

Only use it for true emergencies — such as medical bills, car repairs, or sudden job loss. Avoid dipping into it for vacations or planned expenses.

Q5. How can I rebuild my savings after using it?

Start by setting up automatic transfers from your checking account each payday. Even small, consistent deposits add up over time and rebuild your financial cushion faster.

🌟 The Power of Small Wins

You don’t need thousands of dollars to start. Even setting aside $20 a week adds up faster than you think. Celebrating small milestones — like your first $500 saved — keeps you motivated to reach bigger goals. Remember, financial success is built through steady, consistent actions over time.

🌈 Teaching Financial Responsibility at Home

Saving isn’t just an adult skill — it’s a life skill. The earlier you start talking about money at home, the stronger financial habits your family builds. Teach children the joy of saving through small rewards, or involve your partner in setting shared financial goals. Turning saving into a team effort makes it meaningful and fun for everyone.

Final Thoughts: Secure Your Future, Starting Today 🔑

Building a solid safety net isn’t just about saving — it’s about protecting your lifestyle and making your money work smarter. By choosing a navy federal savings account, you’re ensuring your hard-earned cash grows while staying completely secure.

Remember: even small changes — like switching to a bank with a better rate or exploring new savings options — can dramatically boost your balance over time.

So don’t let your money sit idle.

🚀 Take the first step toward smarter saving today and enjoy the peace of mind that comes from real financial security.