Critical IRS Rules for Venmo, PayPal & CashApp in 2025

The landscape of digital payments has evolved dramatically, and so have the IRS rules governing them. If you’re using Venmo, PayPal, CashApp, or other payment platforms in 2025, understanding these critical regulations could save you from costly penalties and ensure full tax compliance.

Recent legislative changes have significantly altered how payment apps report your transactions to the IRS. Whether you’re running a side hustle, selling items online, or receiving payments for services, these new IRS rules directly impact your tax obligations.

Table of Contents

What Changed with the One Big Beautiful Bill Act?

The One Big Beautiful Bill Act, signed into law on July 4, 2025, brought sweeping changes to tax reporting thresholds. Under this legislation, the 1099-K reporting threshold reverted to $20,000 in payments and 200 transactions in a calendar year, effective for 2025 and beyond.

This represents a dramatic shift from the previous trajectory toward a $600 reporting threshold that had been scheduled for implementation. You can find the complete text of the legislation on Congress.gov.

Timeline of Recent Changes

Here’s how the payment app reporting thresholds evolved:

- 2024: $5,000 threshold (transitional year)

- 2025: $20,000 + 200 transactions (current rule)

- Previously planned: $600 threshold (now indefinitely delayed)

Current IRS Rules for Payment Apps in 2025

The $20,000 Threshold Explained

If you cross the $20,000 threshold in payments AND have more than 200 transactions, the platform is required to send Form 1099-K to you and the IRS in the following year.

Both conditions must be met:

- Dollar Amount: Over $20,000 in total payments

- Transaction Count: More than 200 separate transactions

Who Gets a 1099-K Form?

Payment platforms like Venmo, PayPal, CashApp, and Zelle must issue 1099-K tax forms to users who exceed both thresholds during the calendar year. This includes:

- Freelancers and independent contractors

- Small business owners

- Online sellers (eBay, Facebook Marketplace, Poshmark)

- Service providers (tutoring, pet-sitting, ride-sharing)

- Anyone regularly receiving payments for goods or services

How Do These IRS Rules Affect Different Payment Scenarios?

Personal vs. Business Transactions

The IRS rules distinguish between personal and business payments:

Personal Payments (Generally NOT Reportable):

- Splitting dinner bills with friends

- Paying rent to roommates

- Reimbursing shared expenses

- Gift money from family

- Paying back loans

Business Payments (Potentially Reportable):

- Selling handmade crafts on Etsy

- Freelance graphic design work

- Tutoring services through Wyzant

- Uber or DoorDash earnings

- Selling items for profit on eBay

Real-Life Examples for US Users

Example 1: Sarah’s Side Hustle Sarah sells vintage clothing on Depop and receives $25,000 through PayPal from 250 transactions in 2025. She’ll receive a 1099-K because she exceeded both thresholds.

Example 2: Mike’s Freelancing Mike does freelance web design and earned $18,000 through Venmo from 180 clients. No 1099-K required since he didn’t meet both thresholds.

Example 3: Jessica’s Personal Use Jessica uses CashApp for personal expenses – rent, utilities, and splitting bills. Even with $30,000 in transactions, she won’t receive a 1099-K if they’re personal payments.

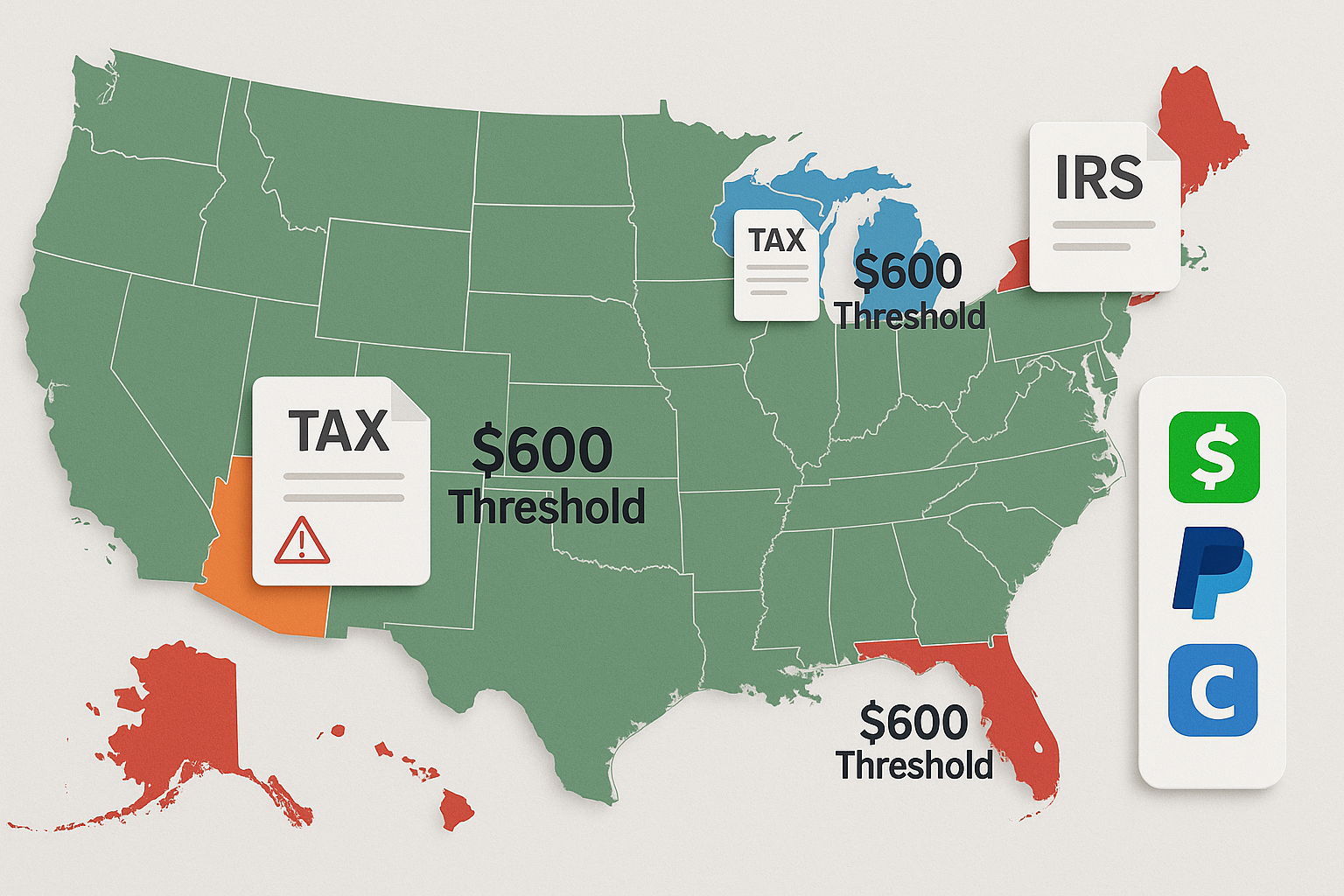

State-Level Variations You Must Know

While federal IRS rules set the baseline, some states have different reporting requirements:

States with Lower Thresholds

- Massachusetts: $600 threshold

- Vermont: $600 threshold

- California: Considering lower thresholds

Tax Implications by State

If you live in Massachusetts or Vermont, you might receive state tax forms even if you don’t qualify for federal 1099-K reporting. Always check your state’s specific tax reporting requirements.

Critical Tax Planning Strategies for 2025

Track Everything, Report Correctly

Even without receiving a 1099-K, you’re still required to report all taxable income on your tax return. The IRS emphasizes that Form 1099-K reports payments from payment apps or online marketplaces and should be used to help figure and report your correct income on your tax return.

Deductible Business Expenses

If you’re receiving business payments through payment apps, remember these deductible expenses:

- Transaction fees charged by payment platforms

- Shipping costs for sold items

- Cost of goods sold for inventory

- Home office expenses if running business from home

- Marketing and advertising costs

Record-Keeping Best Practices

Maintain detailed records for all payment app transactions:

- Screenshot confirmations for each transaction

- Export monthly statements from all platforms

- Categorize personal vs. business payments

- Save receipts for related business expenses

- Use accounting software like QuickBooks or Excel

Common Mistakes That Trigger IRS Audits

Underreporting Income

The biggest red flag is underreporting income from payment apps. The IRS receives copies of all 1099-K forms, making discrepancies easy to detect.

Mixing Personal and Business Accounts

Using the same payment app account for personal and business transactions creates confusion. Consider these strategies:

- Separate accounts: One for personal, one for business

- Clear labeling: Mark business transactions appropriately

- Regular reconciliation: Match records with bank statements

Ignoring State Requirements

Don’t assume federal rules apply to your state. Research your state’s specific payment app tax rules and reporting thresholds.

How to Prepare for Tax Season 2025

January Actions

- Download all 1099-K forms by January 31st

- Organize transaction records from the previous year

- Calculate total income from all payment platforms

- Gather receipts for deductible expenses

February-March Preparation

- Reconcile 1099-K amounts with your records

- Consult a tax professional if needed

- File tax returns by April 15th deadline

- Consider quarterly estimated taxes for 2025

Advanced Strategies for High-Volume Users

Quarterly Estimated Taxes

If you expect to owe more than $1,000 in taxes from payment app income, consider making quarterly estimated tax payments:

- Q1: April 15th

- Q2: June 17th

- Q3: September 16th

- Q4: January 15th (following year)

Business Entity Considerations

High earners should consider forming an LLC or S-Corporation for:

- Tax advantages

- Legal protection

- Professional credibility

- Simplified bookkeeping

Technology Tools for Compliance

Recommended Apps and Software

- QuickBooks Self-Employed: Automatic transaction categorization

- FreshBooks: Invoice tracking and expense management

- Wave Accounting: Free bookkeeping for small businesses

- TurboTax: Integrates with major payment platforms

- Mint: Personal finance tracking with tax categorization

Integration Benefits

Many accounting tools now integrate directly with payment apps, automatically importing and categorizing transactions. This reduces manual data entry and improves accuracy for tax reporting.

Future Changes to Watch

Potential Legislative Updates

While the One Big Beautiful Bill Act established current thresholds, future changes remain possible:

- Congressional reviews of reporting requirements

- Inflation adjustments to dollar thresholds

- State-level legislative changes

- Technology updates affecting reporting capabilities

Industry Trends

Payment platforms continue evolving their tax reporting features:

- Enhanced categorization tools

- Real-time tax calculations

- Improved integration with tax software

- Educational resources for users

Frequently Asked Questions

Q1. Do I need to report Venmo, PayPal, or CashApp income under $20,000?

Yes. Even if you don’t receive a 1099-K tax form, the IRS requires you to report all taxable income, no matter the amount.

Q2. What triggers a 1099-K form for payment apps in 2025?

You will receive a 1099-K if you exceed $20,000 in total payments and 200 transactions in a year across any payment app reporting platform.

Q3. How are personal vs. business transactions treated under IRS tax reporting requirements?

Personal payments (like splitting dinner bills or rent) are not taxable.

Business payments (like selling products or freelance work) are taxable and may require reporting via 1099-K tax forms.

Q4. What happens if I don’t report income from payment apps?

Failing to report income can lead to IRS penalties, interest charges, and even an audit since the IRS gets copies of your 1099-K tax forms directly.

Q5. Are there state-specific tax reporting requirements for payment apps?

Yes. States like Massachusetts and Vermont have lower $600 thresholds, so you might receive additional state-level tax forms even if you don’t meet federal thresholds.

State-by-State Compliance Guide

High-Compliance States

Several states have additional tax reporting requirements beyond federal IRS rules when it comes to payment app reporting:

- Massachusetts and Vermont:

- Lower $600 reporting thresholds for 1099-K tax forms

- Additional state-specific tax forms required

- Separate compliance deadlines

- California:

- Considering legislation for lower tax reporting requirements

- Enhanced audit procedures for payment app reporting income

- Additional business license requirements for high-volume sellers

Tax-Friendly States

States without income taxes offer significant advantages for payment app reporting users:

- Florida, Texas, Nevada: No state income tax

- Tennessee, New Hampshire: Limited income tax scope

- Alaska, South Dakota, Wyoming: No state income tax

Professional Resources and Support

When to Hire a Tax Professional

Consider professional help if you:

- Earn over $50,000 annually from payment apps

- Operate in multiple states

- Have complex business structures

- Face audit or compliance issues

- Need quarterly tax planning

Recommended Professional Services

- Certified Public Accountants (CPAs)

- Enrolled Agents (EAs)

- Tax preparation services with payment app experience

- Business attorneys for entity formation

- Bookkeeping services for ongoing compliance

Action Plan for 2025 Compliance

Immediate Steps (This Month)

- Review your 2024 payment app activity

- Download transaction histories from all platforms

- Categorize business vs. personal payments

- Calculate total income received

- Organize supporting documentation

Ongoing Monthly Tasks

- Export monthly statements from all payment apps

- Reconcile transactions with bank records

- Update expense tracking spreadsheets

- Review categorizations for accuracy

- Set aside estimated tax payments

Annual Planning

- Project next year’s income from payment apps

- Plan quarterly estimated tax payments

- Consider business entity formation

- Update record-keeping systems

- Schedule professional tax consultations

Understanding and following IRS rules for payment apps in 2025 doesn’t have to be overwhelming. With proper planning, accurate record-keeping, and awareness of current regulations, you can confidently navigate the tax implications of digital payments.

The key is staying informed about changes in tax reporting requirements and maintaining excellent documentation throughout the year. Whether you’re earning a few hundred dollars from occasional sales or running a full-scale online business, compliance with these IRS rules protects you from penalties and ensures you’re maximizing legitimate deductions.

For more comprehensive money-saving strategies and tax planning tips, explore our guides on cutting monthly expenses, smart finance moves for 2025, and top investment options.

Ready to take control of your finances and maximize your savings potential? Start saving smarter with SmartSaveUSA.com – your trusted source for practical financial guidance and money-saving strategies that work for real Americans.