Introduction

Managing your money doesn’t have to feel overwhelming. If you’ve ever tried budgeting before and failed, you’re not alone. The truth is, most people struggle because they follow unrealistic plans or don’t tailor their budget to their lifestyle. In this guide, we’ll walk step-by-step through how to create a budget that works for you—one you can actually stick to, save with, and feel good about.

Table of Contents

Why You Need a Budget That Actually Works

A budget isn’t about restriction—it’s about freedom. When you know exactly where your money is going, you gain control and reduce stress. Instead of wondering why your paycheck disappears so fast, you’ll finally have clarity.

According to a 2024 survey by Investopedia, nearly 65% of Americans don’t use a detailed budget. That’s why so many feel financial pressure each month.

Budgeting helps you:

✅ Track spending

✅ Pay off debt

✅ Save for future goals

✅ Build long-term wealth

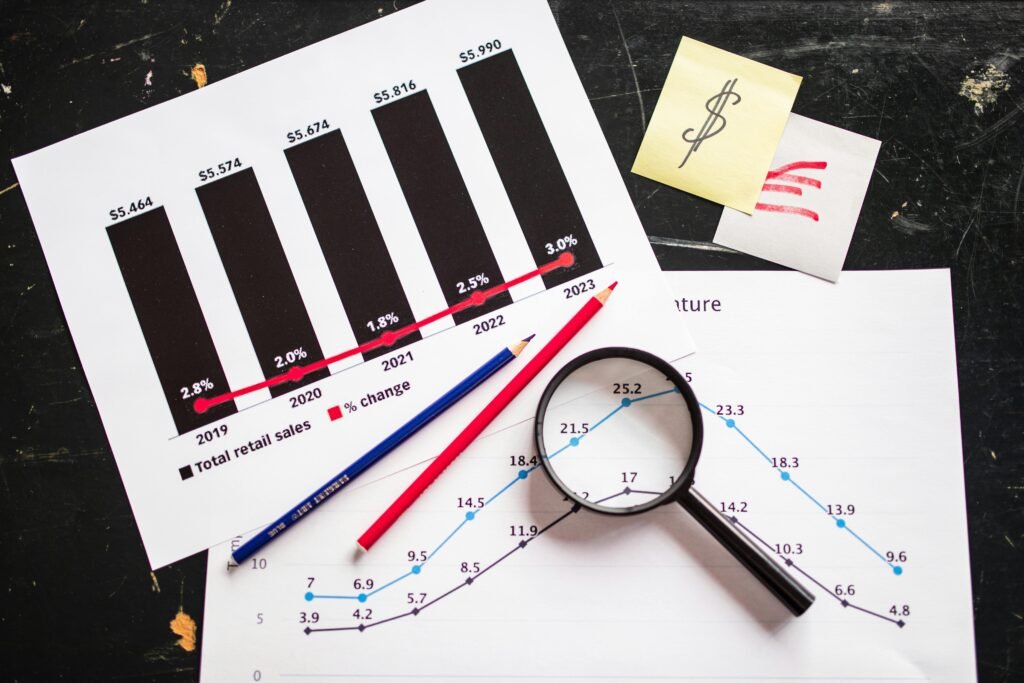

Step 1: Know Your Income and Expenses 📊

The first step to create a budget that works is understanding your cash flow. Write down:

- Your total monthly income (salary, side hustles, etc.)

- Your fixed expenses (rent, utilities, subscriptions)

- Your variable expenses (food, gas, entertainment)

👉 Pro tip: Use banking apps to track where your money goes automatically.

Step 2: Set Realistic Goals 🎯

This is where many people fail—they set unrealistic expectations. A realistic budget plan isn’t about cutting all fun spending. Instead, it balances needs, wants, and savings.

- Short-term goals: Pay off credit cards, save $500 emergency fund

- Long-term goals: Buy a house, retire early, build investments

Keep your goals achievable so you won’t quit after one bad month.

Step 3: Choose an Effective Budgeting Strategy 📝

There’s no one-size-fits-all budget. Different effective budgeting strategies work better for different people.

Popular methods include:

- 50/30/20 Rule: 50% needs, 30% wants, 20% savings

- Zero-based budgeting: Every dollar has a job

- Cash envelope system: Physical envelopes for each category

👉 Try one for 2–3 months before switching. Consistency matters more than perfection.

Step 4: Track Spending and Adjust 🔄

Even the best budget will fail if you don’t track it. Use:

- Budget apps (Mint, YNAB)

- Spreadsheets

- A notebook (if you prefer old school ✍️)

Review your progress weekly. Ask:

- Am I overspending on food or entertainment?

- Can I cut unused subscriptions?

- Do I need to adjust categories?

Budgeting is flexible—it grows with you.

Step 5: Learn How to Stick to a Budget ✔️

Here’s the hard part: how to stick to a budget when temptation is everywhere. Some proven tricks:

- Automate bill payments & savings

- Use cash for impulse-prone categories

- Give yourself a small “fun money” allowance

- Celebrate small wins 🎉

Sticking to a budget doesn’t mean perfection. It means progress over time.

Step 6: Monthly Budget Plan📊

One of the best ways to understand how to create a budget that works is by looking at an example. Here’s a realistic monthly budget plan based on a $3,500 income.

| Category | Percentage | Amount ($) | Notes |

|---|---|---|---|

| Housing (Rent/Mortgage) | 30% | $1,050 | Keep under 30% of income |

| Utilities & Bills | 10% | $350 | Includes electricity, water, internet |

| Food & Groceries | 15% | $525 | Plan meals to avoid overspending |

| Transportation | 10% | $350 | Gas, public transit, car insurance |

| Savings & Investments | 15% | $525 | Emergency fund + retirement |

| Debt Repayment | 10% | $350 | Credit cards, loans |

| Entertainment/Fun | 5% | $175 | Dining out, hobbies |

| Miscellaneous | 5% | $175 | Unexpected costs |

👉 This table shows how to balance needs, wants, and savings. You can adjust percentages based on your lifestyle.

Step 7: Add Money Management Tips 💡

To make your budget even stronger, apply these money management tips:

- Build an emergency fund (start with $500–$1000)

- Pay off high-interest debt first

- Save at least 10–15% of income for retirement

- Review insurance and tax deductions regularly

- Invest in index funds or ETFs once your basics are covered

💡 Related: Big, Beautiful Bill: How Taxes Affect Your Budget

Common Mistakes to Avoid ❌

- Being too strict (leads to burnout)

- Forgetting irregular expenses (car repairs, holidays)

- Not updating your budget after life changes

- Comparing yourself to others

Remember: Your budget is personal. What works for your friend may not work for you.

Tools and Apps to Help You Create a Budget That Works 📱

Creating a budget is easier when you use the right tools. Gone are the days of tracking expenses only on paper. Today, digital tools and apps make budgeting simple, automated, and even fun.

Here are some of the best options to consider:

- Mint (Free) – One of the most popular budgeting apps in the U.S. It connects directly to your bank accounts and credit cards, automatically categorizing your expenses. You get real-time insights into where your money goes.

- YNAB (You Need a Budget) – A paid tool designed for people who want full control. It follows the zero-based budgeting method, ensuring every dollar has a job. Great for people serious about long-term financial discipline.

- Goodbudget – Perfect for envelope-style budgeting. Instead of carrying physical envelopes, this app lets you assign money digitally into different spending categories.

- Personal Capital (Now Empower) – Not only tracks expenses but also helps with investments and retirement planning. A strong choice if you want your budget tied into your long-term financial goals.

- Spreadsheets (Google Sheets/Excel) – If you prefer a DIY method, spreadsheets are free and customizable. Many templates are available online to get you started quickly.

👉 Choosing the right tool depends on your personality. If you love automation, go with Mint. If you prefer control, YNAB or spreadsheets may be better. The key is consistency—the best app is the one you’ll actually use.

Long-Term Benefits of a Budget That Works 🌱

When you create a budget that works and stick with it, you’ll notice:

- Less stress about money 💆

- More savings for emergencies and retirement 💵

- Faster debt payoff 🚫💳

- Improved money habits (you’ll naturally spend smarter)

- Freedom to enjoy life without guilt 🎉

Budgeting isn’t about restriction—it’s about building a financial life you love.

❓ FAQs: About Budgeting

Q1. What is the easiest way to create a budget that works?

👉 People want simple, step-by-step methods (50/30/20 rule, zero-based budgeting).

Q2. How can I stick to a budget without feeling restricted?

👉 This matches your secondary keyword “how to stick to a budget.”

Q3. What is a realistic budget plan for a family?

👉 Families search a lot for “family budget” or “realistic household budget.”

Q4. How much should I save each month from my income?

👉 Highly searched, and you can suggest the 20% savings rule.

Q5. What are the most effective budgeting strategies for beginners?

👉 This matches another of your secondary keywords “effective budgeting strategies.”

Final Thoughts: Build a Budget You’ll Actually Follow 🌟

Learning how to create a budget that works isn’t about spreadsheets or complicated math—it’s about making money work for you. Start small, track your progress, and adjust as needed.

When you combine a realistic budget plan with effective budgeting strategies, the results are life-changing. Not only will you save more and spend smarter, but you’ll finally feel in control of your future.

Take the first step today—your financial freedom is waiting. 🚀