Best Cashback Apps for Uber & Lyft Riders in the USA

With rideshare costs climbing steadily throughout 2025, American consumers are spending an average of $1,200 annually on Uber and Lyft rides, according to recent transportation surveys. Smart riders are fighting back against inflation by leveraging cashback apps for Uber and Lyft that can reduce transportation expenses by 5–15% per trip while also taking advantage of Uber and Lyft rewards programs for extra perks.

Whether you’re a daily commuter in Chicago or an occasional weekend rider in Phoenix, the right strategy can transform your rideshare spending from a budget drain into a rewarding experience. Just as savvy homeowners compare mortgage lenders and mortgage companies to find the best rates, riders can stack multiple cashback apps and rewards programs to maximize their savings on every trip.

Table of Contents

Top Cashback Apps for Uber and Lyft in 2025

Rakuten – The Gold Standard for Rideshare Rewards

When it comes to cashback apps for Uber and Lyft, Rakuten consistently stands out. As one of the best cashback apps for rideshare users, it offers 2–4% cashback rewards for Uber rides and occasionally runs limited-time promotions reaching 8% during peak seasons. The platform’s strength lies in its reliability and quarterly payout system, helping riders save money on Uber and Lyft year-round.

How it works:

- Link your Uber account through Rakuten’s app

- Automatic tracking for all eligible rides

- Quarterly payments via PayPal or check

- No minimum cashout threshold

Real-world example: A Dallas commuter spending $200 monthly on Uber rides earns approximately $96 annually through Rakuten’s standard 4% rate—similar to how homeowners compare mortgage lenders or mortgage companies for the best deals, riders can optimize rewards for maximum savings.

TopCashback – Higher Rates, Slower Payouts

TopCashback is another leader among cashback apps for Uber and Lyft, often delivering the highest cashback rewards for Uber rides with rates reaching 5–6% for both Uber and Lyft. However, payout processing typically takes 2–3 months longer than competitors.

Key benefits:

- Frequently offers the highest cashback percentages

- Covers both Uber and Lyft consistently

- No membership fees or hidden costs

- Mobile app with push notifications for rate increases

This platform is ideal for users willing to wait for larger rewards, making it one of the best cashback apps for rideshare savings enthusiasts.

Capital One Shopping – Credit Card Integration Advantage

Capital One Shopping becomes even more powerful when paired with Capital One credit cards. This approach lets riders save money on Uber and Lyft through a unique stacking strategy:

Stacking strategy:

- Use Capital One Shopping portal (1–3% cashback)

- Pay with Capital One Venture card (2x miles)

- Combine with Uber’s native rewards program

This triple-stacking method turns cashback apps for Uber and Lyft into a serious money-saving tool, much like how savvy borrowers analyze mortgage lenders and mortgage companies to reduce long-term costs.ngs of 7-9% per ride.

Best Cashback Apps for Rideshare: Credit Card Rewards Programs

Chase Sapphire Preferred – Premium Rideshare Coverage

The Chase Sapphire Preferred treats Uber and Lyft purchases as travel expenses, earning 2x Ultimate Rewards points. These points transfer to airline partners at 1:1 ratios, making them particularly valuable for frequent travelers.

Annual value calculation:

- $1,200 rideshare spending = 2,400 points

- Points value: $30-48 depending on redemption method

- Effective return: 2.5-4%

American Express Gold Card – Monthly Uber Credits

American Express Gold cardholders receive $10 monthly Uber credits ($120 annually), plus 4x Membership Rewards points on all Uber purchases. This combination creates exceptional value for regular rideshare users.

Important note: Credits expire monthly and cannot roll over, making this card ideal for consistent users rather than occasional riders.

Cashback Rewards for Uber Rides Through Banking Apps

Bank of America Customized Cash Rewards

Bank of America’s rotating category program occasionally features rideshare as a 3% cashback category. When combined with their Preferred Rewards program, eligible customers can earn up to 5.25% on Uber and Lyft rides.

Quarterly activation required:

- Check Bank of America app monthly for category updates

- Activate rideshare category when available

- Maximum $2,500 spending per quarter at bonus rate

Discover it Card – Quarterly Rotating Categories

Discover frequently includes transportation services in their 5% quarterly categories. The card’s first-year cashback match effectively doubles rewards to 10% during eligible quarters.

Strategic timing:

- Plan major rideshare usage during Discover’s transportation quarters

- Combine with Discover’s year-end cashback match

- Stack with portal rewards when possible

Save Money on Uber and Lyft Through App-Specific Programs

Uber Rewards Program Integration

Uber’s native rewards program offers points earning and redemption opportunities that complement external cashback apps. Gold and Platinum status members receive additional benefits including price protection and priority support.

Status benefits breakdown:

- Blue: 1 point per $1 spent

- Gold: 1.5 points per $1 spent + price protection

- Platinum: 2 points per $1 spent + priority support + flexible cancellations

Lyft Pink Membership Value Analysis

Lyft Pink costs $9.95 monthly but includes 15% savings on rides, priority airport pickup, and relaxed cancellation policies. For riders spending $67+ monthly, the membership pays for itself.

Break-even calculation:

- Monthly fee: $9.95

- Required spending for break-even: $66.33

- Average savings for $200 monthly spender: $21.05

Advanced Stacking Strategies for Maximum Savings

The Triple-Stack Method

Experienced cashback maximizers combine three reward sources simultaneously:

- Portal cashback (Rakuten, TopCashback): 2-5%

- Credit card rewards (travel cards, category bonuses): 2-4%

- Native app rewards (Uber Points, Lyft Pink savings): 1-15%

Real example: A San Francisco professional using this method on a $45 airport ride:

- Rakuten: $1.80 (4%)

- Chase Sapphire: $0.90 (2% as travel)

- Uber Rewards: $0.45 (1% in points)

- Total savings: $3.15 (7% effective rate)

Timing Optimization for Maximum Returns

Cashback rates fluctuate based on promotional periods and seasonal demand. Smart riders monitor rate calendars and time non-urgent trips during peak cashback periods.

Monthly monitoring checklist:

- Check Rakuten’s Big Bonus Days calendar

- Review credit card quarterly category activations

- Monitor flash promotions through cashback apps

- Track Uber/Lyft surge pricing patterns

Uber and Lyft Rewards Programs: Native Platform Benefits

Corporate Partnerships and Employee Discounts

Many large employers partner with rideshare companies to provide employee discounts. Companies like Microsoft, Goldman Sachs, and various hospital systems offer 10-20% discounts through corporate accounts.

Verification process:

- Check with HR department for existing partnerships

- Register corporate email with Uber for Business

- Link personal account to corporate discount program

- Maintain separate personal and business ride tracking

Student and Military Discounts

Both Uber and Lyft offer verified discounts for students and military personnel. These programs typically provide 5-10% ongoing savings plus occasional promotional bonuses.

Eligibility requirements:

- Student: Valid .edu email address and SheerID verification

- Military: Active duty, veteran, or spouse verification through ID.me

- Savings apply automatically after verification

- Can be combined with other cashback methods

Regional Considerations and Local Opportunities

State-Specific Credit Union Programs

Several state credit unions offer enhanced rewards for transportation spending, including rideshare purchases. Navy Federal Credit Union and PenFed frequently feature 3-5% cashback categories covering rideshare services.

When major financial decisions arise – whether refinancing through mortgage lenders or switching between mortgage companies – the same strategic thinking that maximizes rideshare rewards applies to larger financial products. Smart consumers research all available options before committing to any financial service.

Credit union advantages:

- Often higher rates than national banks

- Lower fees and better customer service

- Community-focused rewards programs

- Easier qualification requirements

City-Specific Partnerships and Promotions

Major metropolitan areas frequently negotiate special rideshare promotions during events or seasonal periods. Cities like New York, Los Angeles, and Miami often feature temporary discount programs during tourism seasons.

Examples of city partnerships:

- Las Vegas: Tourism board-sponsored ride credits during convention weeks

- Austin: SXSW promotional codes and cashback bonuses

- Chicago: Winter weather emergency ride subsidies

- Miami: Art Basel weekend enhanced rewards programs

Common Mistakes That Cost Riders Money

Failing to Activate Quarterly Categories

Many riders miss thousands of dollars in potential rewards by forgetting to activate rotating credit card categories. Bank of America, Chase, and Discover require manual activation each quarter.

Prevention strategy:

- Set phone reminders for the first day of each quarter

- Download credit card apps for instant activation

- Create calendar events for category research and activation

- Track quarterly spending limits to maximize bonuses

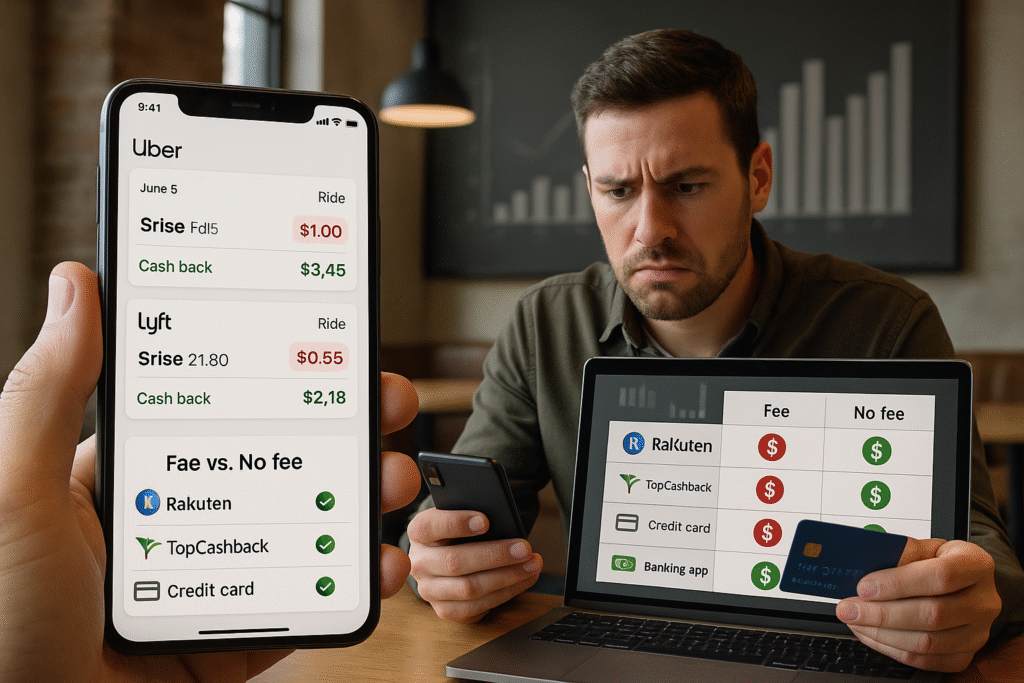

Ignoring Small Transaction Fees

Some cashback platforms charge processing fees that can eliminate savings on smaller rides. Understanding fee structures prevents negative returns on short trips.

Fee comparison analysis:

- Rakuten:No fees, minimum $5 quarterly payout

- TopCashback: No fees, minimum $10 payout

- Credit cards: No additional fees for cashback

- Banking apps: Potential foreign transaction fees for international travel

Technology Tools for Cashback Optimization

Browser Extensions and Mobile Apps

Automated tools can significantly improve cashback capture rates by providing real-time rate comparisons and activation reminders.

Recommended tools:

- Honey: Automatic coupon application and rate monitoring

- InvisibleHand: Price comparison across platforms

- Rakuten browser extension: One-click activation and rate alerts

- Capital One Shopping: Universal price comparison tool

Spreadsheet Tracking for Serious Optimizers

Advanced users maintain detailed tracking spreadsheets to identify patterns and optimize timing for maximum returns.

Key tracking metrics:

- Monthly rideshare spending by platform

- Effective cashback rates achieved

- Quarterly category utilization rates

- Annual rewards totals by source

Future-Proofing Your Rideshare Savings Strategy

Emerging Technologies and Payment Methods

Digital wallets and cryptocurrency cashback cards are creating new opportunities for rideshare rewards. PayPal, Apple Pay, and select crypto cards offer additional earning potential.

2025 trends to watch:

- Cryptocurrency cashback cards (2-4% in Bitcoin)

- Digital wallet promotional bonuses

- AI-powered spending optimization tools

- Integration with smart home and vehicle systems

Loyalty Program Evolution

Both Uber and Lyft continuously evolve their rewards programs based on competitive pressure and user feedback. Staying informed about program changes ensures continued optimization.

Program monitoring sources:

- Official rideshare company blogs and announcements

- Credit card company quarterly updates

- Cashback platform promotional calendars

- Personal finance community forums and websites

FAQs About Cashback Apps for Uber and Lyft

Q1: What are the best cashback apps for Uber and Lyft in 2025?

Some top-performing options include Rakuten, TopCashback, Capital One Shopping, and credit card programs like Chase Sapphire Preferred and American Express Gold Card. These platforms work much like comparing mortgage lenders or mortgage companies—researching multiple options helps you find the best rates or rewards for your needs.

Q2: Can I combine multiple cashback apps and rewards for one Uber or Lyft ride?

Yes, you can stack rewards by using a cashback portal (Rakuten/TopCashback), paying with a rewards credit card, and earning Uber and Lyft rewards points simultaneously. The same principle applies when comparing mortgage lenders to get the best home loan offers—more research often leads to bigger savings.

Q3: How much can I realistically save using cashback apps for Uber and Lyft?

Typical savings range from 5–15% per ride when stacking apps, credit card rewards, and native Uber/Lyft programs. Just as savvy borrowers save thousands by comparing mortgage lenders or switching mortgage companies, riders can save $150–400 annually with the right cashback strategies.

Q4: Do cashback apps also work for Uber Eats or Lyft Delivery services?

Some cashback platforms include Uber Eats under separate categories, but rates are often different. It’s similar to how mortgage companies offer varying rates and benefits—always read the fine print before committing.

Q5: Which credit cards give the best rewards for Uber and Lyft rides?

Popular cards include Chase Sapphire Preferred (2x points on travel, including rideshare), American Express Gold (monthly Uber credits + 4x points), and Bank of America Customized Cash Rewards (up to 5.25% during rideshare bonus categories). Like selecting the right mortgage lenders, choosing the right credit card can maximize your long-term savings.

Conclusion: Start Maximizing Your Rideshare Savings Today

The best cashback apps for Uber and Lyft can transform your transportation budget from a necessary expense into a strategic advantage. By implementing the stacking strategies outlined above and staying current with promotional opportunities, typical riders save $150-400 annually without changing their travel patterns.

Success requires consistent activation of quarterly categories, strategic credit card usage, and patience with varying payout schedules. The effort invested in optimizing your rideshare rewards strategy pays dividends that extend far beyond transportation savings.

Ready to revolutionize your approach to personal finance optimization? Explore more money-saving strategies and expert insights at SmartSaveUSA.com. From travel hacking techniques to birthday dining deals and fast food savings strategies, we’re your trusted source for practical financial wisdom that works in the real world.