Introduction

Are you tired of watching your mortgage balance creep down at a snail’s pace? Bi-weekly mortgage payments could be your secret weapon to slash thousands off your total interest and shave years off your loan term. This simple payment strategy has helped millions of American homeowners build wealth faster while reducing their debt burden significantly.

Instead of making 12 monthly payments per year, this approach involves splitting your monthly payment in half and paying that amount every two weeks. This results in 26 payments annually – equivalent to 13 monthly payments instead of 12.

Table of Contents

Why This Payment Strategy Works Like Magic

The math behind this accelerated payment method is surprisingly powerful. By making that extra payment each year, you’re attacking the principal balance more aggressively than traditional monthly payments.

Here’s a real example: Let’s say you have a $300,000 mortgage at 6.5% interest with a 30-year term. Your monthly payment would be approximately $1,896. With payments of $948 every two weeks, you’d pay off your loan in about 25 years and save roughly $89,000 in interest.

The Compound Effect of Extra Principal Payments

When you make accelerated payments, that extra money goes directly toward your principal balance. Since mortgage interest is calculated on the remaining principal, reducing this amount faster means less interest accumulation over time.

The savings become more dramatic with higher interest rates. As of 2025, with mortgage rates fluctuating between 6.5% and 7.5%, the potential savings from this strategy are substantial compared to the historically low rates we saw in previous years.

How Much Money Can You Actually Save?

The savings from this payment method depend on several factors: your loan amount, interest rate, and remaining term. However, most homeowners can expect to save between 15-25% on total interest payments.

Consider these examples based on current 2025 mortgage scenarios:

- $250,000 loan at 7% for 30 years: Traditional payments = $1,663/month. Accelerated payments save approximately $78,000 and reduce the term by 5.5 years.

- $400,000 loan at 6.8% for 30 years: Monthly payments = $2,629. Switching to this method saves about $119,000 and cuts 5.7 years off the loan.

- $500,000 loan at 7.2% for 30 years: Monthly payments = $3,361. The accelerated approach results in savings of roughly $151,000 with a 5.4-year reduction in loan term.

Beyond Interest Savings: Building Equity Faster

This payment strategy doesn’t just save money – it accelerates equity building. Faster equity accumulation can be crucial for refinancing opportunities, home equity loans, or simply increasing your net worth more rapidly.

According to the Federal Housing Finance Agency, home equity has become increasingly important as property values continue rising across most US markets in 2025.

Step-by-Step Guide to Implementation

Step 1: Contact Your Mortgage Servicer

Not all lenders offer automatic programs for this payment method, and some charge setup fees ranging from $300 to $500. Call your servicer (whether it’s Wells Fargo, Chase, Bank of America, or others) to discuss your options.

Step 2: Calculate Your Payment Amount

Simply divide your current monthly payment by two. If you pay $2,000 monthly, your amount would be $1,000 every two weeks.

Step 3: Set Up Automatic Transfers

Many homeowners prefer the DIY approach to avoid lender fees. Set up automatic transfers from your checking account to a separate savings account every two weeks, then make one extra monthly payment annually.

Step 4: Apply Extra Payments to Principal

Ensure any additional payments go toward principal reduction, not future payments. This distinction is crucial for maximizing your savings.

Smart Strategies to Maximize Your Mortgage Savings

The Hybrid Approach: Combining Multiple Strategies

Many successful homeowners combine bi-weekly mortgage payments with other acceleration strategies. For instance, applying tax refunds, work bonuses, or cashback rewards from credit cards like the Chase Freedom Unlimited or Citi Double Cash directly to principal.

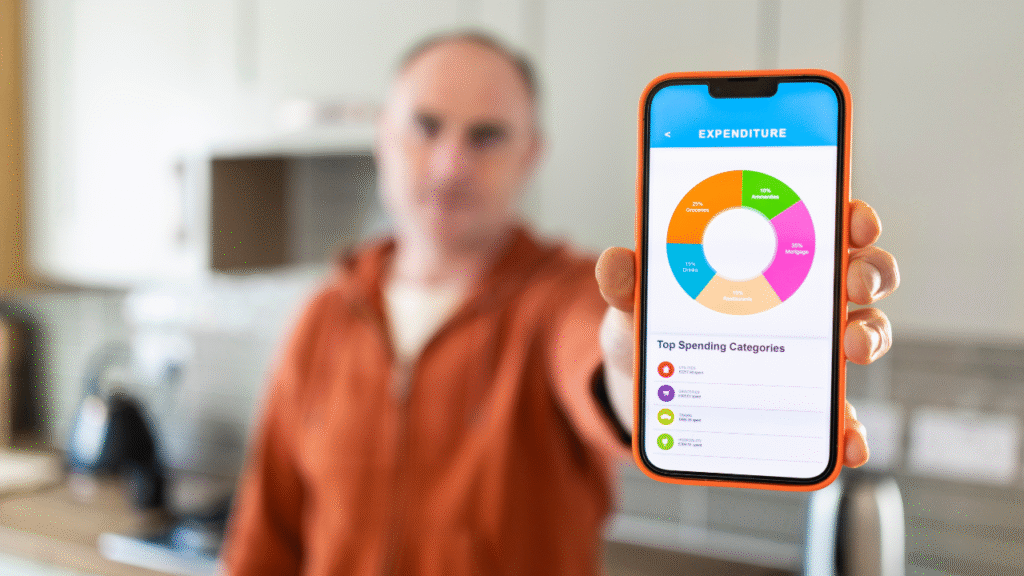

Using Technology to Your Advantage

Modern budgeting apps and smart AI budgeting tools can help you manage the transition to this payment schedule more effectively. These tools track your payment timeline and calculate real-time savings.

Timing Your Switch for Maximum Impact

The earlier in your loan term you implement this strategy, the greater your savings. However, even homeowners halfway through their mortgages can benefit significantly from this approach.

When This Strategy Might Not Be Right for You

High-Interest Debt Priorities

If you’re carrying credit card debt with interest rates above 18% or personal loans with high rates, prioritize paying these off before implementing this mortgage strategy. The guaranteed savings on high-interest debt typically outweigh mortgage acceleration benefits.

Investment Opportunity Considerations

Some financial advisors argue that extra mortgage payments might not be optimal if you can invest the money for higher returns. However, the guaranteed savings from accelerated payments provide peace of mind and risk-free returns equivalent to your mortgage interest rate.

Cash Flow Flexibility Needs

This payment method requires consistent cash flow every two weeks instead of monthly. Ensure your budget can handle this frequency change, especially if your income varies seasonally or you’re self-employed.

Alternative Mortgage Acceleration Methods

The Annual Extra Payment Strategy

If scheduling payments every two weeks feels overwhelming, consider making one extra monthly payment annually. This approach captures about 80% of the benefits with simpler management.

Round-Up Payment Programs

Many homeowners round their monthly payments to the nearest $50 or $100. For example, if your payment is $1,847, rounding to $1,900 adds $636 annually toward principal reduction.

Windfall Application Strategy

Apply unexpected money – tax refunds, work bonuses, inheritance, or savings from electric car fuel cost reductions – directly to your mortgage principal for significant acceleration without changing your regular payment schedule.

2025 Market Conditions and Payment Acceleration

Current economic conditions make accelerated mortgage payments particularly attractive for American homeowners. With inflation concerns and fluctuating interest rates, locking in guaranteed savings through this strategy provides financial stability.

The Consumer Financial Protection Bureau emphasizes that homeowners should carefully evaluate their complete financial picture before committing to accelerated payment strategies. However, for those with stable incomes and manageable debt levels, this approach offers compelling benefits.

Recent Federal Reserve data shows that household debt service ratios remain elevated, making mortgage acceleration strategies increasingly valuable for long-term financial health.

Real-Life Success Stories from American Homeowners

Sarah, a teacher from Ohio, started this accelerated payment strategy on her $180,000 home loan in 2020. By consistently applying the method along with her annual tax refunds from early tax refund programs, she’s projected to save over $45,000 in interest and pay off her home six years early.

Mike and Jennifer, a couple from Texas, combined this approach with their Costco Executive membership cashback rewards applied to principal. Their disciplined strategy is saving them approximately $67,000 on their $275,000 mortgage.

FAQs: About Bi-Weekly Mortgage Payments

Q1.Do bi-weekly mortgage payments really save money?

Yes — they reduce the total interest paid and shorten your loan term.

Q2.How much faster can I pay off my mortgage with bi-weekly payments?

Typically 4–6 years earlier on a 30-year loan.

Q3.Are there fees for setting up bi-weekly mortgage payments?

Some lenders charge setup fees, but many offer it free.

Q4.What’s the difference between monthly and bi-weekly mortgage payments?

Bi-weekly payments mean 26 half-payments a year, equal to 13 full payments instead of 12.

Q5.Can I switch back to monthly payments after choosing bi-weekly?

Yes, but you need to confirm with your lender or servicer.

Take Action: Start Your Mortgage Acceleration Journey Today

This accelerated payment approach represents one of the most straightforward ways to build wealth through your home equity while reducing long-term debt obligations. The strategy requires minimal effort once established but delivers substantial financial benefits over time.

Before implementing this method, review your complete financial picture, ensure stable cash flow, and consider consulting with a financial advisor if you have complex circumstances.

Ready to explore more money-saving strategies and smart financial tips? Visit SmartSaveUSA.com for expert guidance on budgeting, debt reduction, and wealth-building techniques tailored for American families. Start saving smarter today with proven strategies that work in any economic climate.