Fed Raises Rates: Key Details for US Savers

Fed raises rates again: On February 12, 2025, the Federal Reserve increased its benchmark federal funds rate by 0.25 percentage points, bringing it to 5.50–5.75% the highest level since 2001. This decision underscores the Fed’s ongoing battle against inflation, which remains above its 2% target even after easing slightly in late 2024.

For US consumers and savers, the latest rate hike is a mixed bag. It means higher returns on savings accounts and CDs but also steeper costs for credit cards, mortgages, and other loans.

Table of Contents

Why the Fed Raised Rates Again

Federal Reserve Chair Jerome Powell cited “persistent inflationary pressures” and a strong labor market as key drivers.

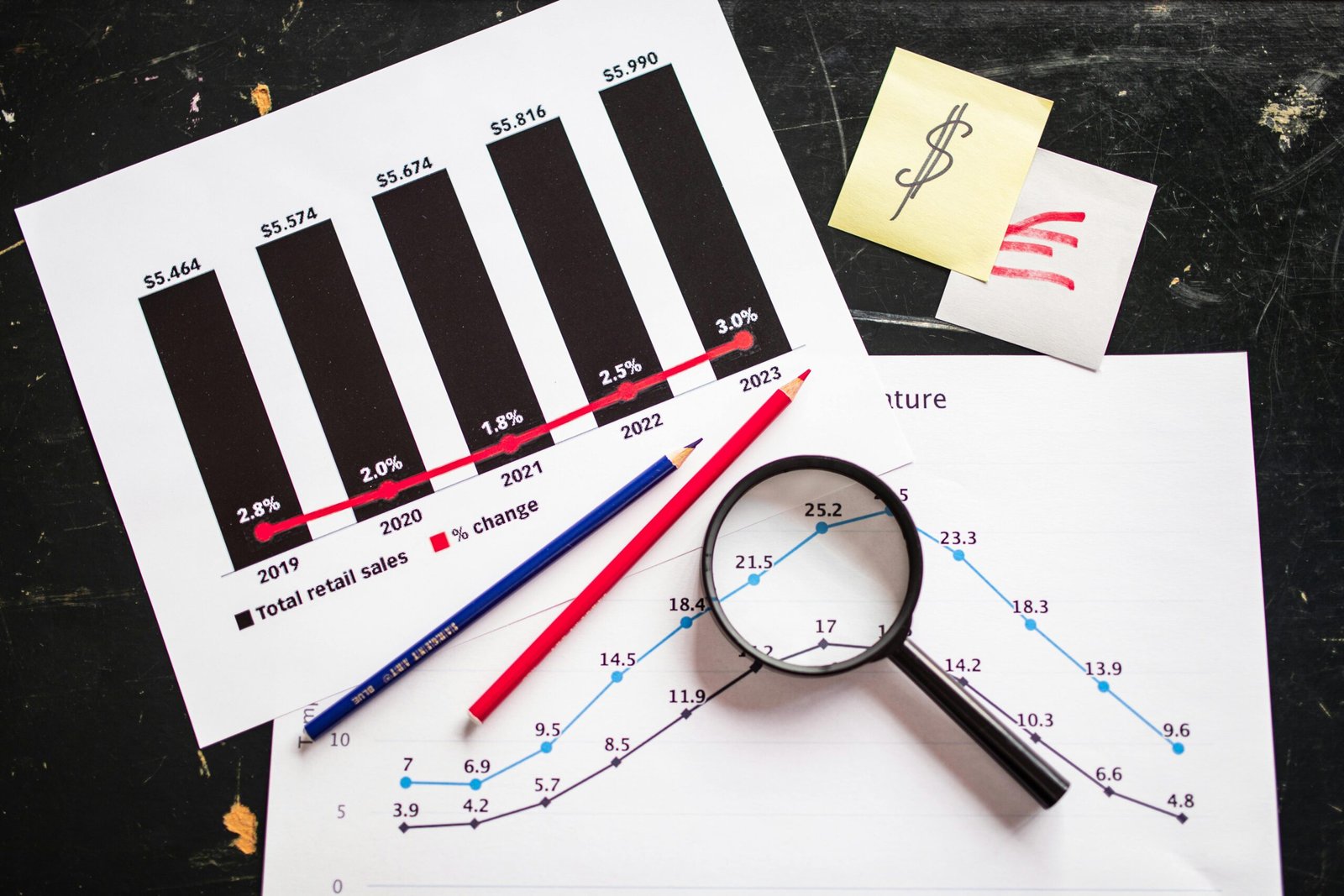

According to the Bureau of Labor Statistics, January 2025 inflation came in at 3.1%, slightly down from December but still above target. Economic growth remained steady, with retail spending at stores like Walmart and Target rising 2.3% year-over-year.

“The Fed remains committed to restoring price stability, even if that means tighter financial conditions for households and businesses,” Powell said at the post-meeting press conference. Full details are available in the Federal Reserve’s official monetary policy statement.

Impact on Savings Accounts and CDs

For savers, a rate hike often translates into better returns:

- High-Yield Savings Accounts (HYSAs): Many online banks, including Ally and Marcus, are expected to raise yields to 5% or more in coming weeks.

- Certificates of Deposit (CDs): One-year CDs at banks like Capital One and Discover could top 5.3%, according to FDIC data.

As of 2025, this marks a major turnaround from the near-zero interest rates seen during the pandemic era.

Credit Cards, Loans, and Monthly Budgets

Not all effects are positive. For households carrying credit card balances, higher rates mean bigger bills:

- Average credit card APRs in the US have climbed to 22.5%, per Federal Reserve data.

- Variable-rate mortgages and auto loans will also rise, squeezing budgets for millions of families.

Example: A $5,000 credit card balance could cost an extra $12–15 per month in interest after this hike.

Inflation and Consumer Prices

While higher rates help curb inflation, price growth in key areas like groceries and utilities remains elevated. The U.S. Energy Information Administration reported a 4% rise in electricity costs compared to last year, hitting households across states like Texas and California.

The Fed’s goal: make borrowing costlier to slow spending, ultimately cooling prices. But for now, everyday essentials remain pricey.

What Savers Should Do Now

To benefit from rising rates:

- Shop for High-Yield Accounts: Online banks often pass rate hikes to customers faster than brick-and-mortar institutions.

- Lock in CD Rates: If you have extra cash, consider 1-year CDs before banks lower yields if the Fed pauses hikes later this year.

- Pay Down Debt: Rising APRs make carrying credit card balances increasingly expensive.

[Insert related SmartSaveUSA link here]

What’s Next for Rates

Economists expect the Fed may hold rates steady through mid-2025 if inflation cools. However, if prices stay stubbornly high, another hike is possible by summer.

US consumers should watch upcoming inflation reports and Fed meeting minutes for clues on the next move.

FAQs: Fed Raises Rates — What US Savers Need to Know

Q1: How does the Fed raises rates decision affect savings accounts in the USA?

When the Fed raises rates, banks often follow by boosting yields on high-yield savings accounts (HYSAs) and certificates of deposit (CDs). Savers could see better returns within weeks, especially at online banks.

Q2: Will credit card interest rates rise after the February 2025 Fed raises rates move?

Yes. Most credit cards in the USA have variable rates linked to the Fed funds rate. After the Fed raises rates, APRs typically climb in the next one or two billing cycles, making debt more expensive.

Q3: What should US savers do after the Fed raises rates?

It’s smart to pay off high-interest credit card balances first, then shop around for the best HYSA and CD rates. Locking in top CD rates now could be wise if future Fed decisions pause or reverse.

Q4: How quickly do banks change rates after the Fed raises rates?

Some banks adjust within days, especially online institutions competing for deposits. Traditional banks may take longer, so checking multiple banks after each Fed raises rates decision helps you find the best deals.

Q5: Does the Fed raises rates decision always lower inflation in the USA?

Not instantly. Higher interest rates help slow borrowing and spending, which can cool inflation over time. But prices for essentials like groceries and utilities may take months to reflect changes.

Final Thoughts: What’s Next After the Fed Raises Rates

As of February 2025, the latest Fed raises rates decision shows the central bank’s commitment to taming inflation, even if it means higher borrowing costs for households. For US savers, this is a chance to lock in better yields on savings accounts and CDs while staying mindful of rising credit card APRs.

If you’re looking to make your money work harder, consider exploring Wells Fargo’s $325 checking bonus for extra cash incentives or learn how passive income from small-town rentals could help offset inflation impacts.

The next few months will be crucial as the Fed watches inflation data closely before making another move. Savers should stay informed, compare interest rates, and be ready to pivot as the economic landscape evolves.